Fed governor warns Trump policy may hurt economy

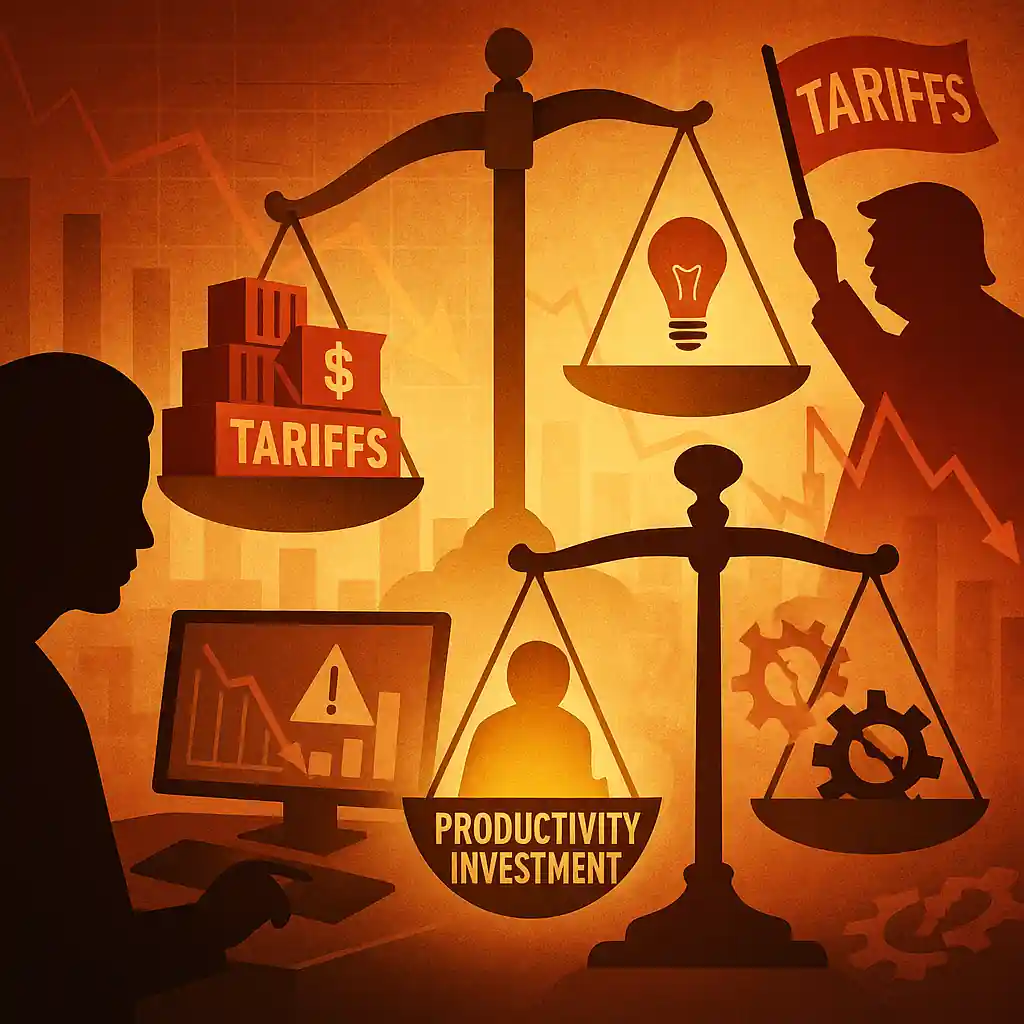

President Trump’s evolving trade policies could weaken U.S. productivity and increase inflationary pressures, Federal Reserve Governor Lisa Cook warned Friday. Speaking at Stanford University, Cook said new tariffs and policy uncertainty could slow investment and reduce economic efficiency.

Her remarks suggest the Fed is monitoring how Trump’s trade decisions may reshape the economy’s long-term potential.

Trump’s tariffs may stall investment and innovation

According to Cook, firms are hesitant to invest due to uncertainty over Trump’s trade stance. They lack clarity on tariff levels, duration, and enforcement. That ambiguity can cause businesses to delay or cancel productivity-enhancing projects.

“Uncertainty around trade policy is likely to reduce business investment going forward,” she said, referencing Trump’s latest trade shifts.

Trump policies could raise inflation and Fed rates

Cook also said higher costs for imported materials, triggered by Trump’s tariffs, could force the Fed to raise rates. As productivity falls and supply chains suffer, the economy becomes less efficient.

That inefficiency tightens available output and increases price pressures. “Greater inflationary pressure” may lead to “higher interest rates,” Cook warned, even as growth slows.

Trump-era trade barriers prop up inefficient firms

The Fed governor pointed out another risk: Trump’s protectionist trade strategy could support inefficient domestic firms. Higher trade barriers often shield underperformers from global competition, making the U.S. economy less dynamic.

Increased costs and inefficiencies from Trump’s tariffs could therefore drag down long-term growth and innovation.

Productivity slowdown a real risk under Trump

While artificial intelligence may boost productivity over time, Cook said it’s unclear if it can offset the drag caused by Trump-era trade disruptions.

She stressed that trade policy, especially when used to raise barriers, has real costs. “Less capital investment can lead to slower technological adoption,” she explained.

Fed faces tough choices as Trump reshapes policy

If Trump‘s trade measures continue to limit economic potential, the Fed may face a dilemma. With productivity declining and prices rising, it could be forced to tighten monetary policy even as growth slows.

This scenario would require the Fed to walk a narrow line—managing inflation while avoiding recession. It could be the most direct economic legacy of Trump’s trade doctrine.

Trump’s trade tactics spark debate at the Fed

Cook’s comments come amid growing internal Fed concern over Trump‘s approach to tariffs and trade. While Trump touts his tough stance as necessary for national strength, economists increasingly question its economic cost.

With potential output at risk, the Fed’s next moves may depend on how trade tensions evolve. For now, Cook’s message is clear: Trump’s policies carry inflation risks that could complicate monetary strategy.