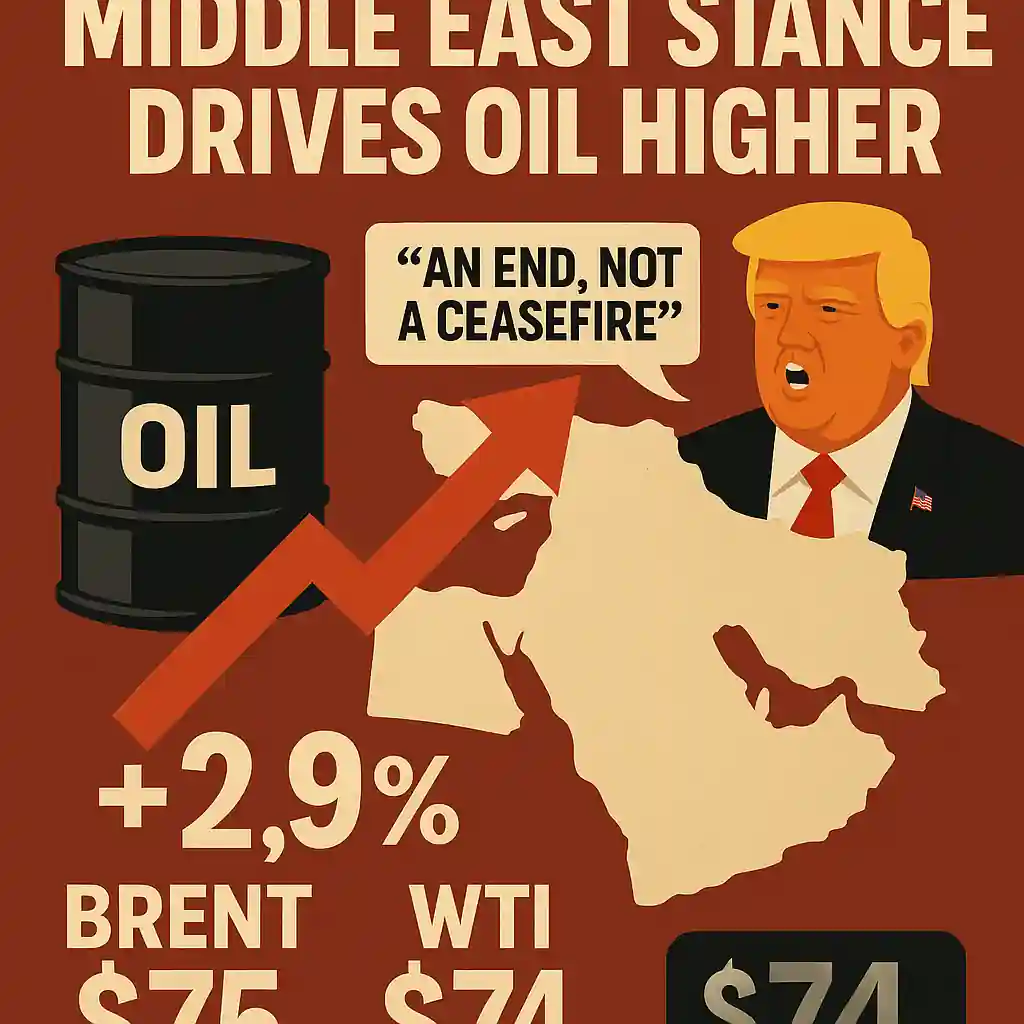

Trump’s Middle East stance drives oil higher

Oil prices surged nearly 3% on Tuesday following President Trump’s remarks on the Israel-Iran conflict.

Brent futures crossed $75 per barrel, while WTI crude hovered near $74. Markets reacted swiftly to geopolitical uncertainty.

Trump urged evacuations in Iran’s capital overnight, triggering concerns about a possible regional war.

Investors fear a broader conflict could destabilize energy markets, disrupt supply, and inflate oil prices globally.

Ceasefire hopes fade as Trump demands “an end”

Trump dismissed ceasefire efforts suggested by France’s President Macron, calling for “a real end, not a ceasefire.”

On Air Force One, he refused to detail next steps but emphasized a stronger resolution than a temporary pause.

His early departure from the G7 summit also rattled global markets, intensifying uncertainty over U.S. foreign policy.

These mixed signals cloud peace prospects and challenge investor assumptions about geopolitical outcomes.

Trump’s trade policy adds economic uncertainty

Beyond geopolitics, Trump’s tariff policy is creating further anxiety among market participants.

As the deadline to lift the pause on tariffs nears, Trump signed a new trade deal with UK Prime Minister Keir Starmer.

This US-UK pact, finalized in May, marks the first new agreement amid his ongoing “America First” trade agenda.

However, broader concerns persist about Trump’s sweeping tariffs and their potential economic fallout.

Retail sales slump signals consumer hesitation

US retail sales dropped 0.9% in May, missing forecasts and marking a shift from recent pre-tariff spending spikes.

The decline suggests consumers are pulling back amid inflation fatigue and rising uncertainty about future costs.

Analysts link this weakness to tariff-related caution and reduced confidence in stable pricing.

Retailers may face additional challenges if tariffs are reinstated or extended, as consumers remain price sensitive.

Wall Street eyes the Fed for next policy signal

Markets are watching the Federal Reserve’s two-day policy meeting for guidance on rate cuts.

The Fed is expected to hold interest rates steady Wednesday but may signal future cuts for late 2025.

Trump has repeatedly pressured Fed Chair Jerome Powell to slash rates more aggressively.

However, with inflation easing, the Fed is likely to remain cautious before acting.

Stock markets retreat on Trump-fueled volatility

US stocks fell on Tuesday as hopes for Middle East peace dwindled. Trump’s rhetoric contributed to investor caution.

The Dow declined 0.2%, the S&P 500 slipped 0.3%, and the Nasdaq dropped 0.4%.

These losses came after Monday’s rally, which was driven by Iran’s tentative signals of negotiation.

With peace hopes fading, markets are now repricing risk across equities, oil, and safe havens.

Outlook hinges on Trump’s next moves

Trump’s unpredictable stance on both trade and foreign policy continues to steer global markets.

His actions in the Middle East, coupled with his tariff strategy, have real consequences for energy and equity sectors.

Investors are bracing for more volatility, with oil likely to remain sensitive to his rhetoric.

Whether through geopolitical flare-ups or economic disruption, Trump remains a central force in shaping financial sentiment.