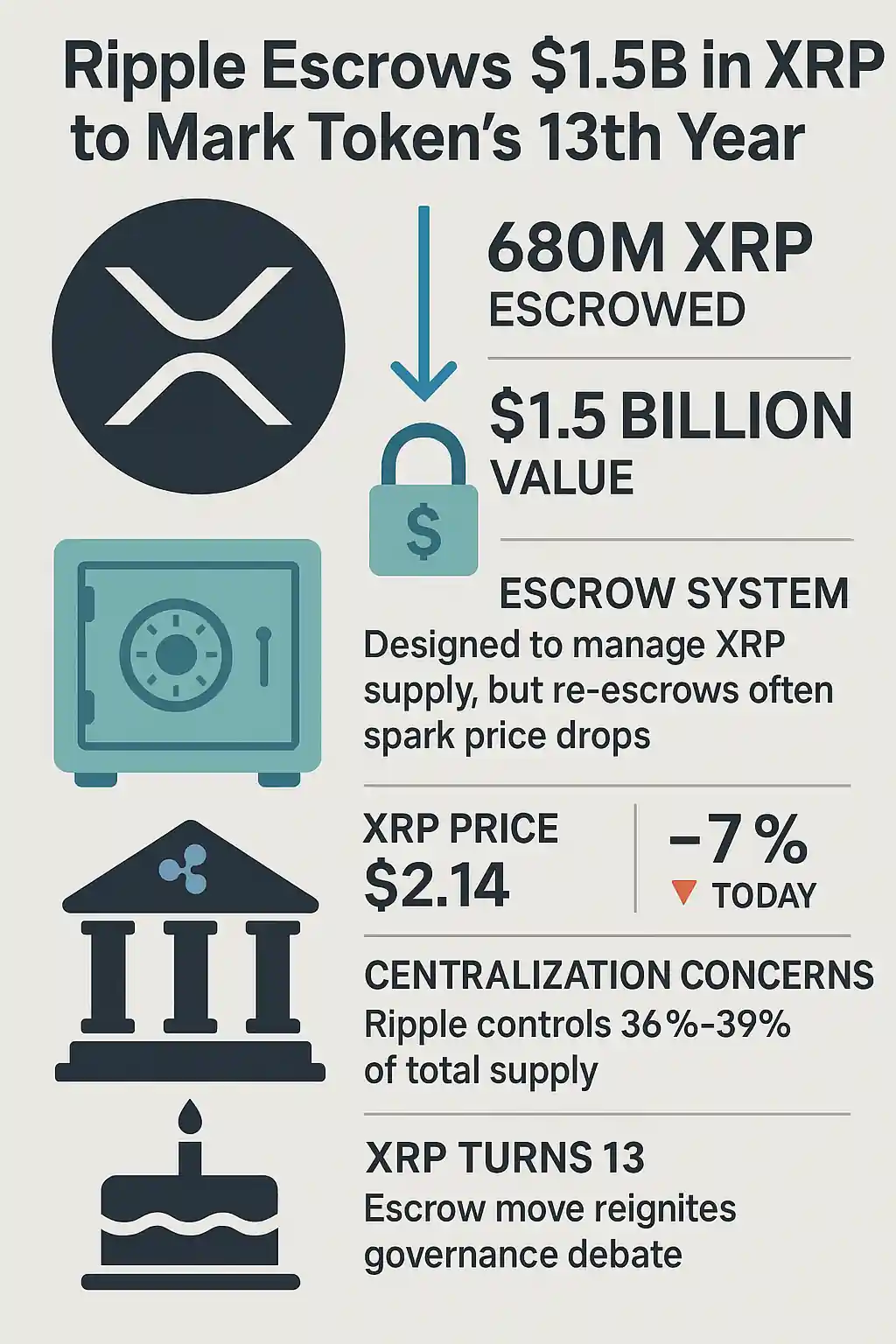

Ripple Escrows $1.5 Billion in XRP to Mark Token’s 13th Year

Ripple marked the 13th anniversary of XRP by locking nearly 680 million XRP, equivalent to approximately $1.5 billion, into escrow wallets. This move aligns with Ripple’s long-standing monthly practice, aiming to manage the circulating supply of XRP and maintain market transparency.

On June 1, blockchain tracking platform Whale Alert recorded two notable transactions. One transferred 470 million XRP (about $1.03 billion), while the other moved 200 million XRP (around $437 million). These massive re-escrows have again placed Ripple’s token management strategy in the spotlight.

Escrow Designed for Predictability, Not Price Stability

Ripple’s escrow system is meant to provide predictability for XRP’s circulating supply. The company accesses up to 1 billion XRP per month to meet operational demands such as institutional partnerships. Unused tokens are returned to escrow, keeping the remaining XRP off the market.

While structurally sound, these actions often spark short-term bearish sentiment. Historically, large re-escrow transactions have correlated with XRP price declines. The most recent one-billion-XRP escrow reportedly coincided with a 24% drop in price.

Currently, XRP is trading at $2.14, down over 7% in the last 24 hours, reflecting a pattern of post-escrow sell pressure that continues to weigh on investor sentiment.

Centralization Concerns Continue to Shadow XRP

Ripple’s influence over XRP supply remains controversial. As per data from XRPScan, Ripple controls 36–39% of the total XRP supply, including both escrowed and unescrowed holdings. Historical estimates placed Ripple’s control even higher, around 45–55%.

This centralization has fueled debate among XRP holders. A widely circulated Reddit thread on r/Cryptocurrency expressed skepticism:

“What stops Ripple from not sending the unsold XRP back into escrow? It’s not code-based — it’s trust-based.”

While Ripple has consistently stated its commitment to returning the majority of unused tokens each month, critics argue that without on-chain enforcement, trust in Ripple remains a key dependency.

Market Reaction Mixed as XRP Turns 13

Celebrating 13 years since launch, XRP remains one of the most widely recognized cryptocurrencies. Yet, questions over token ownership, transparency, and price stability continue to polarize the community.

The $1.5 billion escrow move — while routine — has become emblematic of the larger governance debate surrounding XRP. Analysts continue to regard such re-escrow events as neutral to bearish in the short term but acknowledge the long-term credibility the system brings to Ripple’s tokenomics.

As the crypto industry matures, XRP’s future may hinge on how effectively Ripple balances transparency, decentralization, and institutional utility.