Oil Rises After US Inventory Report

Oil rose after a weekly report from the Energy Information Administration revealed a sharp 6-million-barrel decline in US stockpiles. Traders interpreted the drawdown as a signal of stronger demand, giving crude markets a boost. The report helped offset recent bearish sentiment driven by oversupply concerns.

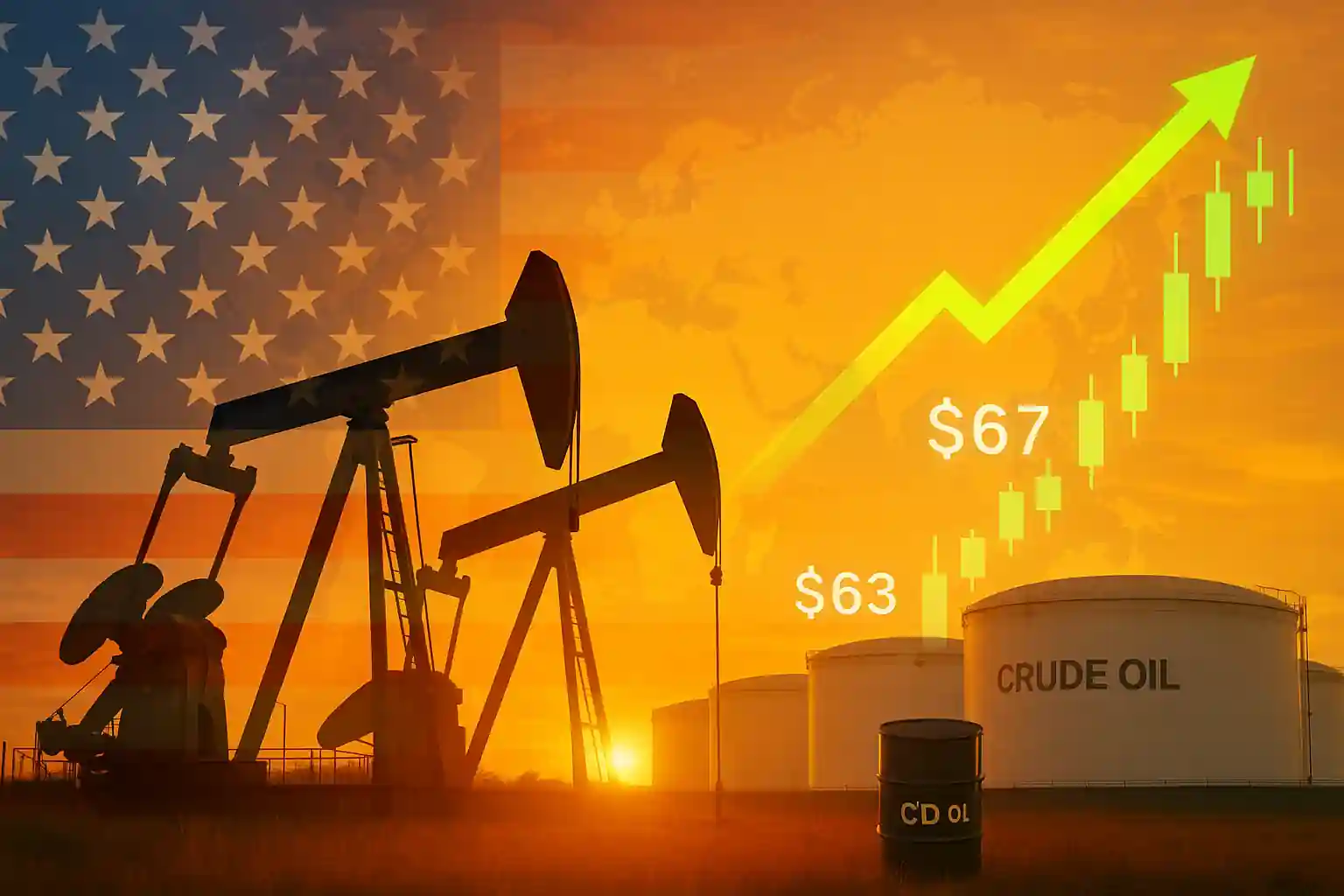

WTI and Brent Futures Edge Higher

Oil rose after futures markets reacted positively to the latest data. West Texas Intermediate September and October contracts both climbed, with October trading near $63 a barrel. Brent futures also advanced, recovering to nearly $67 a barrel after Tuesday’s pullback. Futures gains highlight optimism despite geopolitical uncertainty.

Traders Monitor Russia-Ukraine Negotiations

Oil rose after the market turned its focus to ongoing Russia-Ukraine negotiations. Traders are closely watching the diplomatic process for signs of a breakthrough. Any truce could reshape sanctions policies and alter global supply flows. Until then, volatility remains elevated as uncertainty drives speculative positioning.

Impact of Declining US Stockpiles

Oil rose after the sharp drop in inventories, which were expected to show a smaller decline. The larger-than-anticipated draw supports the view of resilient demand despite global economic concerns. Lower US stockpiles often provide price stability, though broader market forces may still dominate in the weeks ahead.

Global Supply Risks Persist

Oil rose after the bullish inventory news, but supply risks continue to weigh on sentiment. Russia’s role in global exports remains crucial, and OPEC+ production increases add another layer of uncertainty. Analysts warn that any sudden disruption in Russian supply could tighten markets significantly, reversing recent price softness.

Technical Outlook for Crude Prices

Oil rose after futures broke short-term resistance levels. Analysts see technical support for WTI near $61 a barrel, with upside potential toward $65. Brent futures may target $68 if demand signals remain positive. However, a failure in peace talks could quickly erase gains and trigger sharp selloffs.

Economic Data and Demand Signals

Oil rose after the EIA data aligned with other economic indicators pointing to steady demand. Growth in industrial activity and transportation continues to support consumption. Traders are balancing this demand outlook with potential headwinds from inflation, interest rates, and slowing global trade.

Market Outlook in Coming Weeks

Oil rose after recent volatility but remains vulnerable to geopolitical outcomes. If Russia and Ukraine reach a ceasefire, sanctions could ease, pushing more supply onto global markets. Conversely, if negotiations fail, tighter restrictions may drive prices upward again. Market participants expect choppy trading until clarity emerges.