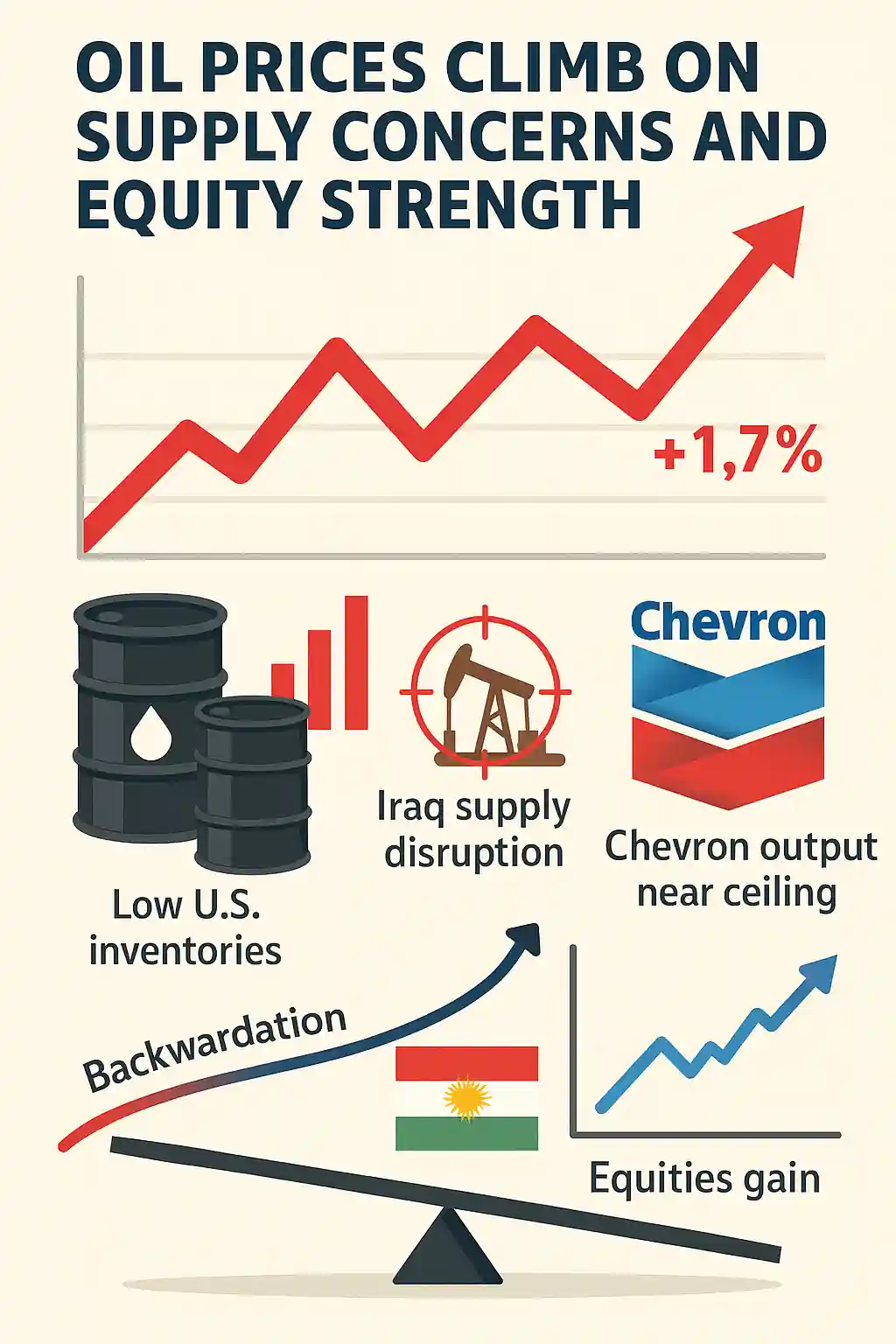

Oil Prices Climb on Supply Concerns and Equity Strength

Oil rose sharply Thursday, with West Texas Intermediate (WTI) crude climbing 1.7% to surpass $67 a barrel. This rally breaks a three-day losing streak and comes as U.S. equity markets posted gains. Stronger equities often signal increased economic optimism, which typically supports oil.

U.S. Economic Data Eases Demand Worries

Oil found support after better-than-expected U.S. economic data calmed fears of a potential slowdown. Investors had feared weaker demand, but those concerns have eased. As broader markets moved higher, oil followed, reflecting rising confidence in the outlook for consumption.

Physical Market Tightens Amid Global Disruptions

Several key supply indicators turned bullish. U.S. crude inventories declined last week, tightening domestic stock levels. Meanwhile, Iraq lost 200,000 barrels per day of oil production due to drone attacks on Kurdistan oil fields. Chevron also reported nearing peak output in the Permian, signaling a limit to near-term U.S. supply growth.

Goldman Sachs Highlights Supply Side Fragility

According to Daan Struyven, Goldman Sachs’ head of oil research, the oil market has shifted its focus. “Stocks in pricing centers, especially the U.S., are still quite low,” he said. Struyven added that downside risks to oil supply are becoming more prominent than demand concerns.

Kurdish Oil Exports to Resume, Limiting Rally

While oil rallied, upside was capped by news that Iraq approved a plan to resume Kurdish oil exports. These exports had been suspended since March 2023. The Kurdistan Regional Government is expected to supply 230,000 barrels per day to Iraq’s state marketer SOMO.

Forward Curve Reflects Supply Tightness

The crude futures market is currently in backwardation, a structure where short-term contracts are more expensive than long-term ones. This pricing pattern indicates immediate demand for oil and concern over short-term supply disruptions.

U.S. Distillate Inventories Remain Extremely Low

Adding to the bullish tone, U.S. distillate inventories remain at their lowest seasonal level since 1996—even after a modest increase last week. This reflects ongoing tightness in refined oil product markets, which supports crude demand as refiners maintain strong throughput.

Outlook: Oil Faces Supply Risk Despite Headwinds

Although oil prices are still down for the year, the recent rally underscores how quickly sentiment can shift. If geopolitical or infrastructure risks increase further, oil could rally again. Still, resumed Kurdish exports and ongoing macro concerns may temper sustained gains.