Oil Prices Hold Steady Ahead of Key Market Catalysts

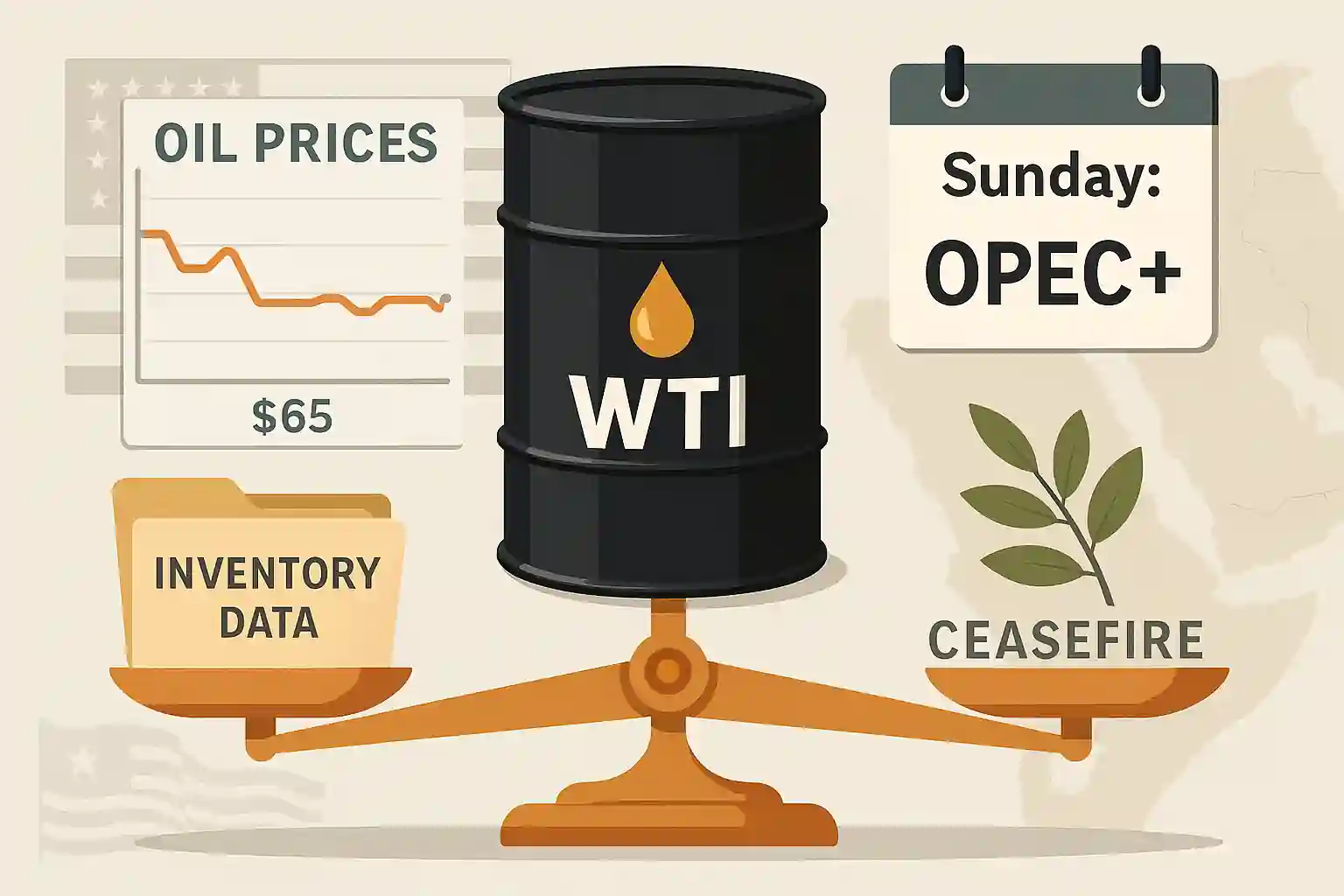

Oil remained stable this week, with traders eyeing a trio of critical market-moving events. West Texas Intermediate hovered just above $65 per barrel as momentum slowed. Volumes were lighter than usual due to the approaching July Fourth holiday in the U.S.

Oil briefly tested the 100-day moving average of $65.67 but failed to break higher. The muted performance suggests that traders are waiting for more clarity before taking new positions in oil markets.

Market Focus Shifts to OPEC+ Production Decision

Attention now turns to Sunday’s virtual OPEC+ meeting. Expectations are rising that the alliance will announce a production quota hike. Analysts, including Goldman Sachs, anticipate the market will not react sharply to an increase, as such a move is already priced in.

Any signal of supply tightening or restraint, however, could push oil higher. Conversely, a substantial production increase might revive oversupply concerns later this year.

U.S. Inventory and Jobs Data in Spotlight

Beyond OPEC+, U.S. economic data is also in focus. Later this week, traders will digest official oil inventory figures and a key jobs report. Both will provide insight into demand trends and broader economic health—two important drivers of oil prices.

The American Petroleum Institute reported a 1.4 million-barrel drawdown at the Cushing storage hub. If confirmed by the EIA, it would mark the largest weekly decline since January. Such a drop could bring oil stockpiles to their lowest seasonal level since 2005.

Ceasefire Cools Oil Volatility

Oil volatility has eased since the ceasefire between Israel and Iran. The recent plunge in oil prices reflects a retreat from war-risk premiums. With calm restored in the Middle East, traders have turned their focus back to fundamental supply and demand dynamics.

Trading volumes in crude futures have dipped, echoing the broader wait-and-see market mood. This environment has left oil in a narrow range, awaiting fresh catalysts.

Analysts Expect Limited Reaction from OPEC+ Decision

Goldman Sachs analysts wrote that oil prices are unlikely to see major movement following the OPEC+ meeting unless a surprise announcement occurs. “Consensus has already shifted toward a production increase,” noted the team.

Oil markets appear well-prepared for a moderate rise in output. However, any unexpected deviation from the anticipated decision could quickly jolt prices higher or lower.

Short-Term Stability, Long-Term Questions for Oil

While oil remains stable for now, concerns about a potential supply glut persist. OPEC+ has been steadily restoring output since the COVID-era cuts. If demand doesn’t keep pace, oil prices could come under pressure in the second half of the year.

For the moment, the oil market is in balance—watching, waiting, and responding cautiously to every new headline.