Oil prices climb despite supply glut and weak demand

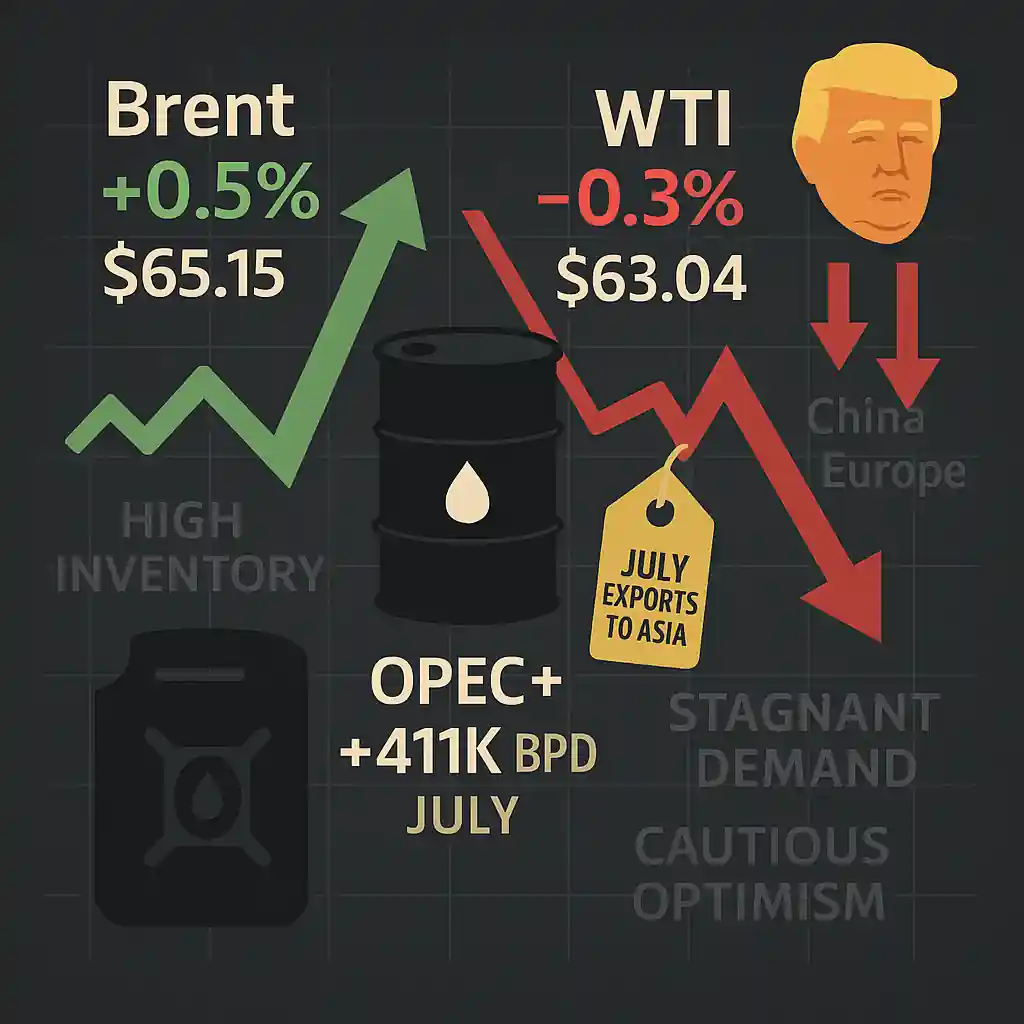

Oil prices ticked higher Thursday morning as traders looked past signs of oversupply and economic headwinds. Brent crude rose 0.5% to $65.15 a barrel. Meanwhile, West Texas Intermediate fell slightly by 0.3% to $63.04 per barrel, showing mixed momentum across benchmarks.

This resilience surprised many analysts, who warned that excessive oil output could cap gains. But optimism still fueled modest price support.

Saudi Arabia cuts prices and raises output

Saudi Arabia, the world’s largest oil exporter, recently cut prices for its Asian buyers for July shipments. This move came amid plans by the OPEC+ alliance to boost output by 411,000 barrels per day next month.

The price cut signals weakening demand, especially in Asia, and a potential shift in strategy from Saudi Arabia. The country appears willing to prioritize market share over price stabilization — a risky gamble in a market already saturated with oil.

OPEC+ production hike raises oversupply alarms

The OPEC+ decision to raise oil production has rattled market observers. Analysts worry that the extra barrels could push the market further into surplus. This comes as inventories remain elevated, and demand expectations weaken amid growing global tensions.

If demand doesn’t accelerate, excess supply could pressure oil prices in the months ahead, despite Thursday’s gains.

Trade tensions threaten global oil demand

Trade tensions, particularly those driven by President Donald Trump’s tariff policies, are also affecting oil market sentiment. Ongoing disputes with China, Europe, and other key partners have slowed manufacturing and freight movement — two big drivers of oil demand.

As tariffs weigh on global growth, analysts fear that consumption of refined products like gasoline and diesel may stagnate or decline, further pressuring oil prices.

Market sentiment defies bearish fundamentals

Despite the bearish fundamentals — rising oil supply and weakening demand — traders seem cautiously optimistic. Some are betting on stronger-than-expected summer travel demand or easing geopolitical tensions to rebalance the market.

Others argue that financial positioning and technical momentum are propping up oil prices in the short term. However, if economic data weakens further, this sentiment may not hold.

Outlook for oil remains volatile

The path ahead for oil remains highly uncertain. Prices could remain range-bound as bullish and bearish forces compete. On one hand, production increases and trade war fallout could limit upside. On the other, hopes for stimulus, global travel recovery, or strategic reserve purchases may offer support.

Until stronger signals emerge, the oil market is likely to remain sensitive to headlines and supply chain shifts.