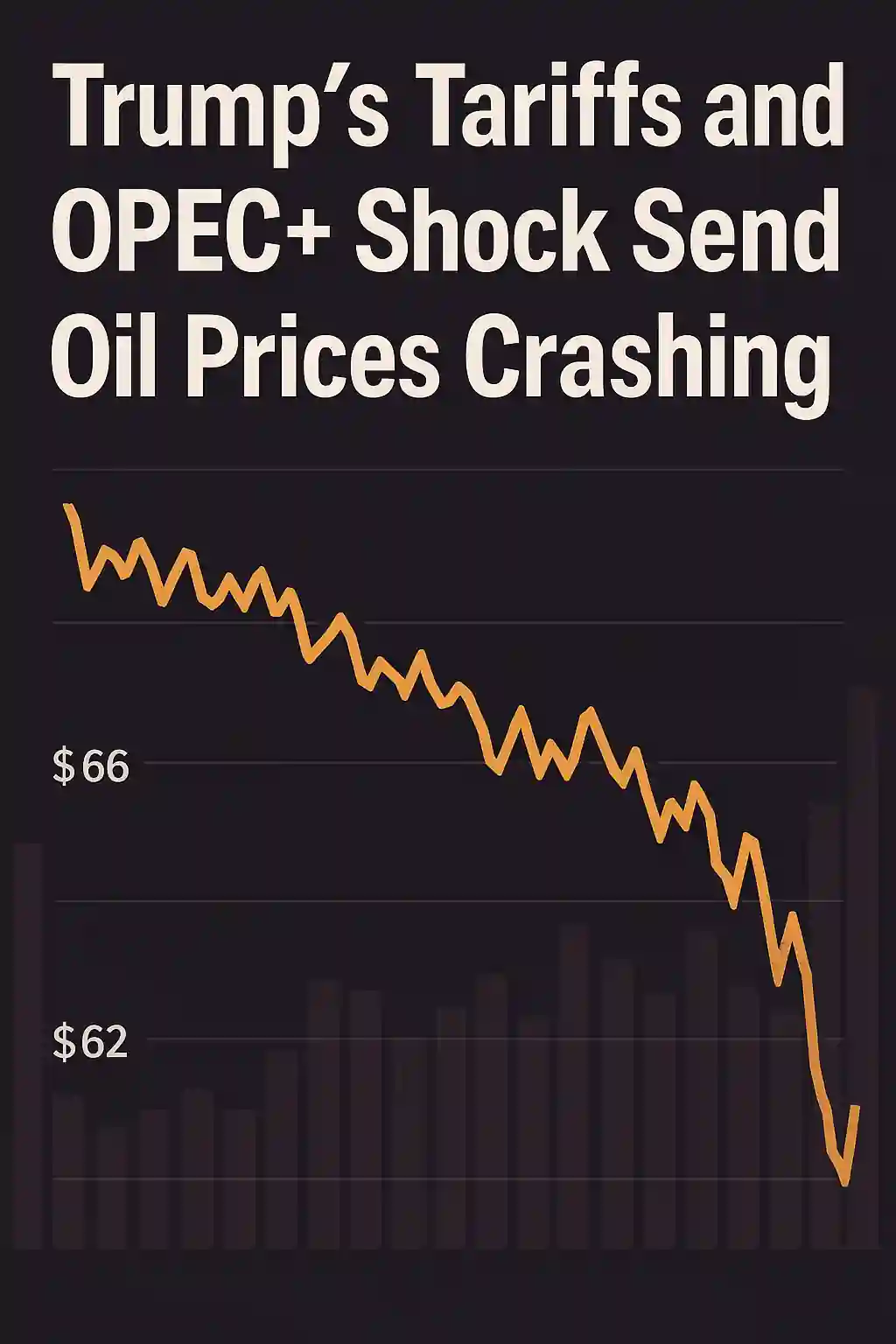

Trump’s Tariffs and OPEC+ Shock Send Oil Prices Crashing

The global oil market was rocked this week as Brent crude tumbled 13% in just two days, falling to $66 a barrel. The twin shock came from President Donald Trump’s sweeping tariffs and a surprise production boost from OPEC+, two events that have rapidly disrupted global energy forecasts.

The drop casts serious doubt on the Trump administration’s goal of achieving US energy dominance, as West Texas Intermediate fell to $61 a barrel, dipping below the $65 breakeven mark required by many US drillers.

Global Demand Forecasts Slashed as Market Sentiment Turns Bearish

Market analysts quickly adjusted their projections. Goldman Sachs slashed its year-end Brent crude forecast by $5, now expecting it to close 2025 at $66. UBS Group AG and Enverus also downgraded global demand forecasts, citing economic uncertainty from the growing trade war.

“This felt like a one-two punch,” said Enverus analyst Al Salazar. “The OPEC timing right after the tariffs announcement suggests coordination or at least opportunism.”

US Shale Faces Mounting Pressure Amid Rising Costs

The US shale industry—a cornerstone of Trump’s energy policy—may be among the biggest losers. A 30% spike in steel pipe costs driven by new tariffs is increasing drilling expenses. Meanwhile, energy stocks have cratered: the S&P 500 Energy Index fell 16% in two days, with APA Corp., Diamondback Energy, and Baker Hughes all sliding more than 20%.

Analysts warn the era of aggressive expansion may be over. “Now it’s not even a consideration,” said Roth Capital analyst Leo Mariani. “Sub-$60 oil changes everything.”

Europe Gets Relief, Middle East Faces Fiscal Strain

Not all are suffering. Europe, which has been battling soaring energy costs, may benefit from lower oil and gas prices. With natural gas hitting a six-month low, European nations can build reserves without facing stiff competition from Asia.

Germany, especially, stands to gain as it works to fill massive storage sites ahead of next winter.

However, Middle Eastern petrostates are feeling the pinch. The IMF estimates that Saudi Arabia and Iraq need oil above $90 per barrel to fund public spending. The timing of the OPEC+ production boost, reportedly pushed by Saudi Arabia, appears aimed at punishing members like Iraq and Kazakhstan who have repeatedly missed output targets.

A Risky Gamble That Could Reshape the Oil Market

The geopolitical dynamics behind this collapse are as critical as the economic ones. Reports suggest US and Saudi officials held talks before the OPEC+ announcement, fueling speculation that the production increase was designed to amplify the effects of Trump’s tariffs.

But with many OPEC+ members reliant on high oil prices, this move may prove risky. Saudi Arabia is already delaying flagship projects tied to Vision 2030, and Kazakhstan’s breakeven price exceeds $115, making the current levels unsustainable.

A New Reality for Oil Markets

Oil traders and energy companies alike are adjusting to a harsh new reality: lower prices, higher costs, and unpredictable trade policy. As gasoline prices fall in the US, Trump may score a short-term political win, but at the cost of longer-term industry growth.

“You almost feel like this move from OPEC was the additional driver to push people towards saying, ‘Ok, now I really have to think about a sub-$60 price,’” said UBS analyst Josh Silverstein.