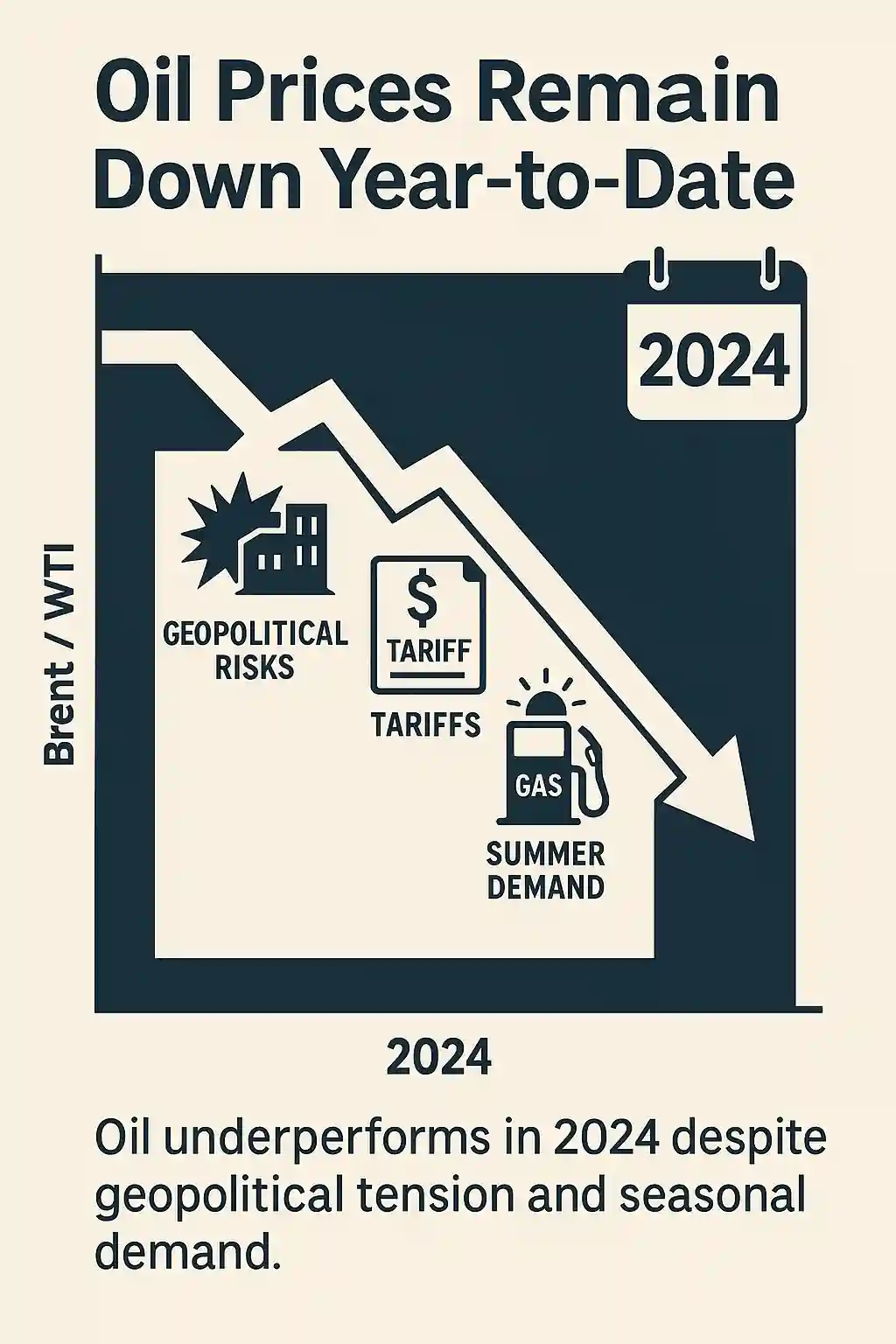

Oil Prices Remain Down Year-to-Date

Despite a turbulent backdrop, oil prices continue to underperform. Both Brent and WTI crude remain lower for the year, defying expectations of a sustained rally. Volatility linked to geopolitical conflict and trade uncertainty hasn’t been enough to lift oil above 2024 highs.

Geopolitical Risks Fail to Boost Oil Prices

While tensions in the Middle East and fears over the Strait of Hormuz have triggered brief spikes, oil prices have quickly cooled. Traders appear unconvinced that current conflicts will disrupt supply long-term. Without a clear threat to production or transport, oil remains range-bound.

Tariff Concerns Add Another Layer of Pressure

U.S. trade policy is also weighing on the oil market. Upcoming tariff decisions are raising questions about global demand. If trade tensions worsen, economic growth could slow, leading to weaker oil consumption. This potential drag is keeping oil bulls cautious.

Technical Outlook Suggests Continued Weakness

LPL Financial’s chief technical strategist, Adam Turnquist, expects oil prices to stay under pressure. His analysis indicates a downward trend is likely to persist, even amid macro-level tensions. Technical resistance levels are holding firm, and buyers lack momentum.

Short-Term Rallies Met with Selling Pressure

Even when oil prices rise briefly—due to war headlines or inventory drops—those gains are often erased. Traders quickly sell into strength, suggesting limited confidence in a longer-term rally. This behavior reflects broader market skepticism.

Fundamentals Do Not Fully Support Higher Oil

Despite OPEC+ efforts to manage supply, global oil inventories remain sufficient. Production from non-OPEC nations, including the U.S., continues to rise. With demand forecasts staying modest and alternative energy sources gaining ground, oil faces multiple structural headwinds.

Summer Demand Not Enough to Shift Trend

Even peak summer demand has not been able to reverse oil’s downward path. Gasoline consumption rises during travel season, but it has not translated into a sustainable oil price breakout. This indicates that broader market forces are still overpowering seasonal trends.

Oil Market May Stay Subdued Through 2025

Unless a major supply disruption occurs, oil prices may continue to lag. Analysts like Turnquist suggest the market needs a clear shift in fundamentals—or a sharp geopolitical shock—to break out of its current slump. For now, oil appears stuck in a bearish trend.