2024 Oil Market Wrap-Up: A Year of Decline

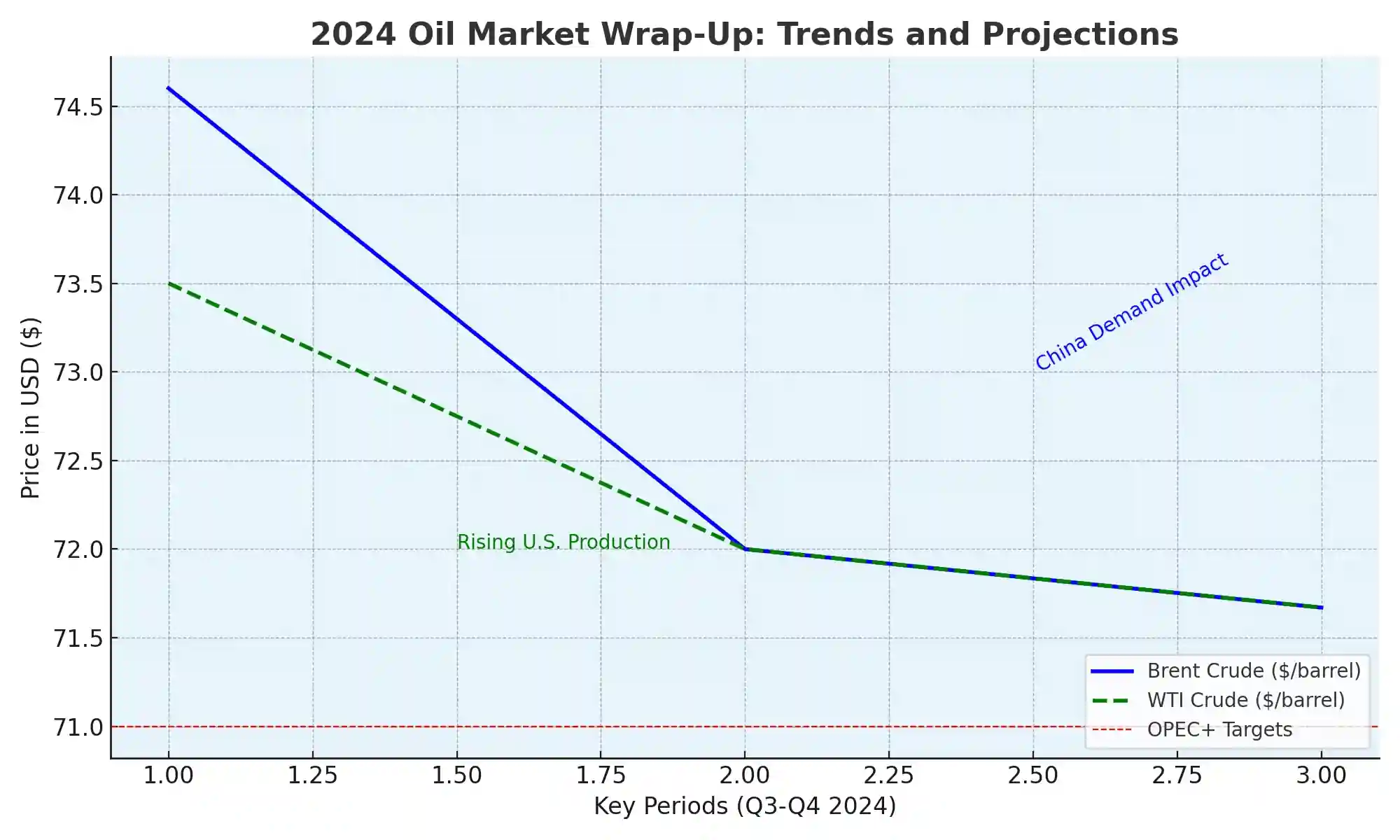

Oil prices are set to close 2024 with a second consecutive annual loss. Brent crude traded at $74.60 per barrel, while U.S. West Texas Intermediate (WTI) held at $71.67 per barrel, reflecting a 3.2% decline from Brent’s 2023 close. Both benchmarks remain far below the highs of recent years, constrained by subdued post-pandemic recovery, China’s economic struggles, and surging U.S. output.

Surging U.S. Production Amid Weak Global Demand

U.S. crude production hit a record 13.46 million barrels per day (bpd) in October, supported by robust domestic demand, which surged to 21.01 million bpd—the highest since August 2019. The U.S. Energy Information Administration (EIA) projects production will reach 13.52 million bpd in 2025, intensifying global supply concerns.

Meanwhile, weak demand growth in China, the world’s largest oil importer, has led both the International Energy Agency (IEA) and OPEC to reduce forecasts for 2024 and 2025. With non-OPEC supply rising, the oil market faces a surplus, even after OPEC+ postponed its planned output increase to April 2025.

Economic Trends and Federal Reserve Policies in Focus

The Federal Reserve’s cautious rate-cut trajectory for 2025 could influence oil demand. Lower interest rates typically stimulate economic growth, potentially boosting energy consumption. However, stubborn inflation and geopolitical uncertainties may hinder these benefits.

Geopolitical Risks and Trump’s Policy Impact

President-elect Donald Trump’s administration could reshape the oil market in 2025. His anticipated policy shifts include looser regulations, renewed sanctions on Iran, and calls for a ceasefire in the Russia-Ukraine conflict.

Stricter sanctions on Iranian oil could tighten global supply, creating upward pressure on prices. Additionally, China’s manufacturing expansion in December—bolstered by new stimulus measures—provides some optimism for the world’s second-largest economy.

Global Supply Threats and Security Concerns

The U.S. military’s recent strikes on Houthi targets in Yemen highlight ongoing security risks to global oil flows. The Red Sea region has witnessed attacks on commercial shipping, threatening key supply routes. These developments, coupled with India’s firming demand and improving Chinese manufacturing data, could lend support to prices moving into 2025.

What Lies Ahead for Oil Markets in 2025

As 2025 approaches, oil markets will navigate a complex landscape of rising U.S. production, geopolitical uncertainty, and OPEC+ supply management. While demand growth in emerging economies may provide a lifeline, the interplay of macroeconomic policies and global supply dynamics will likely dominate the year’s outlook.