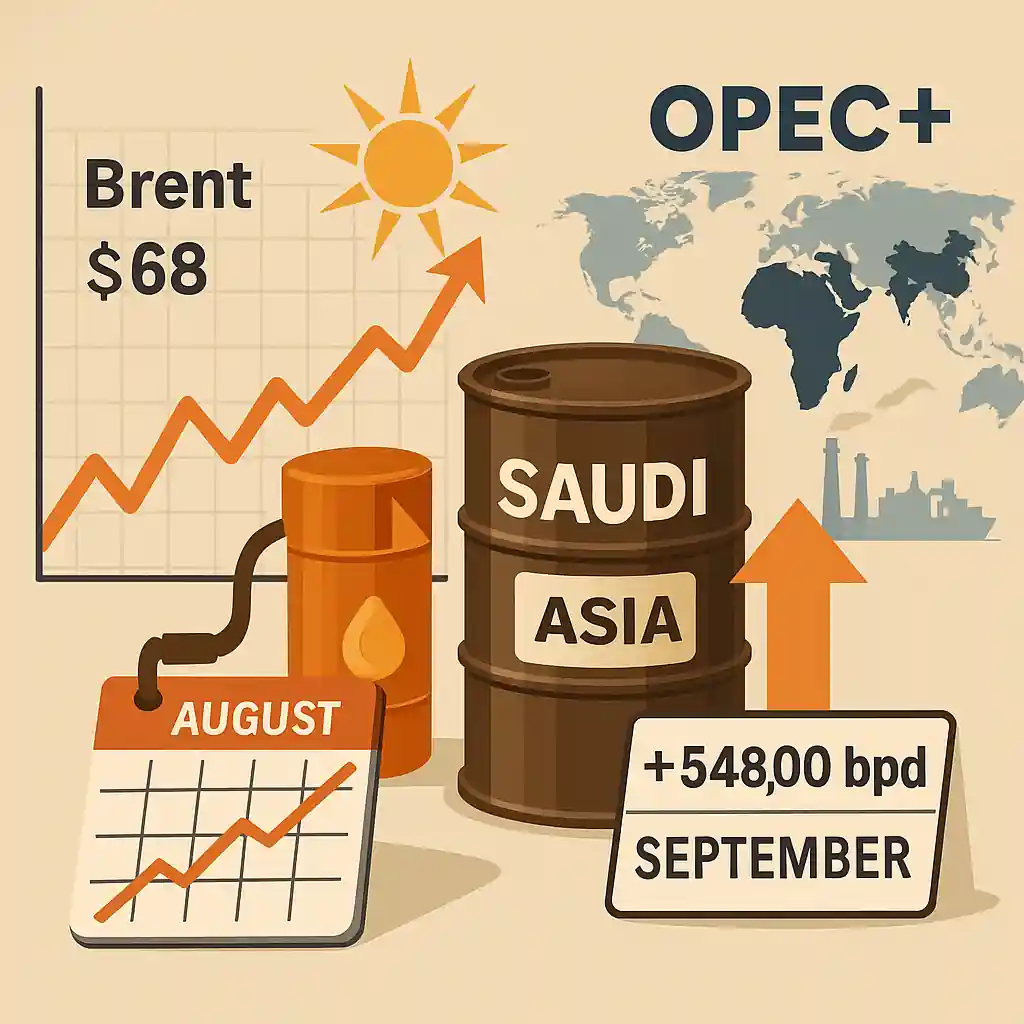

Oil Climbs as OPEC+ Raises August Output

Oil prices edged higher on Monday, with Brent crude trading above $68 a barrel after briefly dipping earlier in the session. The gains came as eight OPEC+ nations agreed to boost oil supply by 548,000 barrels per day in August. Additional increases may follow in September, keeping the oil market under close watch.

Saudi Arabia Shocks Asia with Crude Price Hike

In a surprising move, Saudi Arabia raised prices for its main oil grade sold to Asia. This price hike during peak summer demand signals tight supply conditions. Analysts see this as proof that the market can absorb extra oil — at least for now. The decision supports oil prices, despite the recent ramp-up in output.

Tight Market Fundamentals Support Oil Stability

“The decision to raise prices during summer suggests that physical markets remain tight,” said Ole Hansen of Saxo Bank. He added that current conditions suggest downside risks to oil are limited in the short term. Oil continues to find support from seasonal demand and reduced inventories.

Israel-Iran Ceasefire Shifts Market Focus

Since the Israel-Iran conflict paused, oil has been trading in a narrow range. Brent previously spiked above $80 but has since stabilized. With geopolitical risk cooling, trader attention is shifting back to supply fundamentals and U.S. trade policies that may impact global demand for oil.

OPEC+ Strategy Shifts Toward Market Share Recovery

OPEC+ had already increased oil output by 411,000 barrels per day in May, June, and July — triple its earlier pace. The August increase marks a dramatic shift from restraint to aggressive market share recovery. The group is capitalizing on strong demand and tight supply to reassert control over the global oil landscape.

Additional Oil Output Likely in September

The group’s next meeting is scheduled for August 3. Delegates have suggested another 548,000 bpd increase could be approved for September. That would complete the reversal of the 2.2 million bpd cut made in 2023. Goldman Sachs expects this full restoration to be confirmed in the upcoming meeting.

Strong Outlook, But Seasonal Risks Remain

OPEC+ justified the production increases with a steady global economic outlook and strong oil fundamentals. Yet some analysts warn of seasonal weakness ahead. Robert Rennie of Westpac noted that oil prices could face pressure after summer, when demand typically tapers off.

Oil Market Eyes Tariffs and Global Trade Policy

U.S. trade policy remains another wild card. Officials signaled that new tariffs could be enforced by August 1. These measures could impact global oil demand if trade tensions escalate. For now, oil remains supported by supply-side discipline and summer-driven consumption.