Oil surges as OPEC+ announces July supply boost

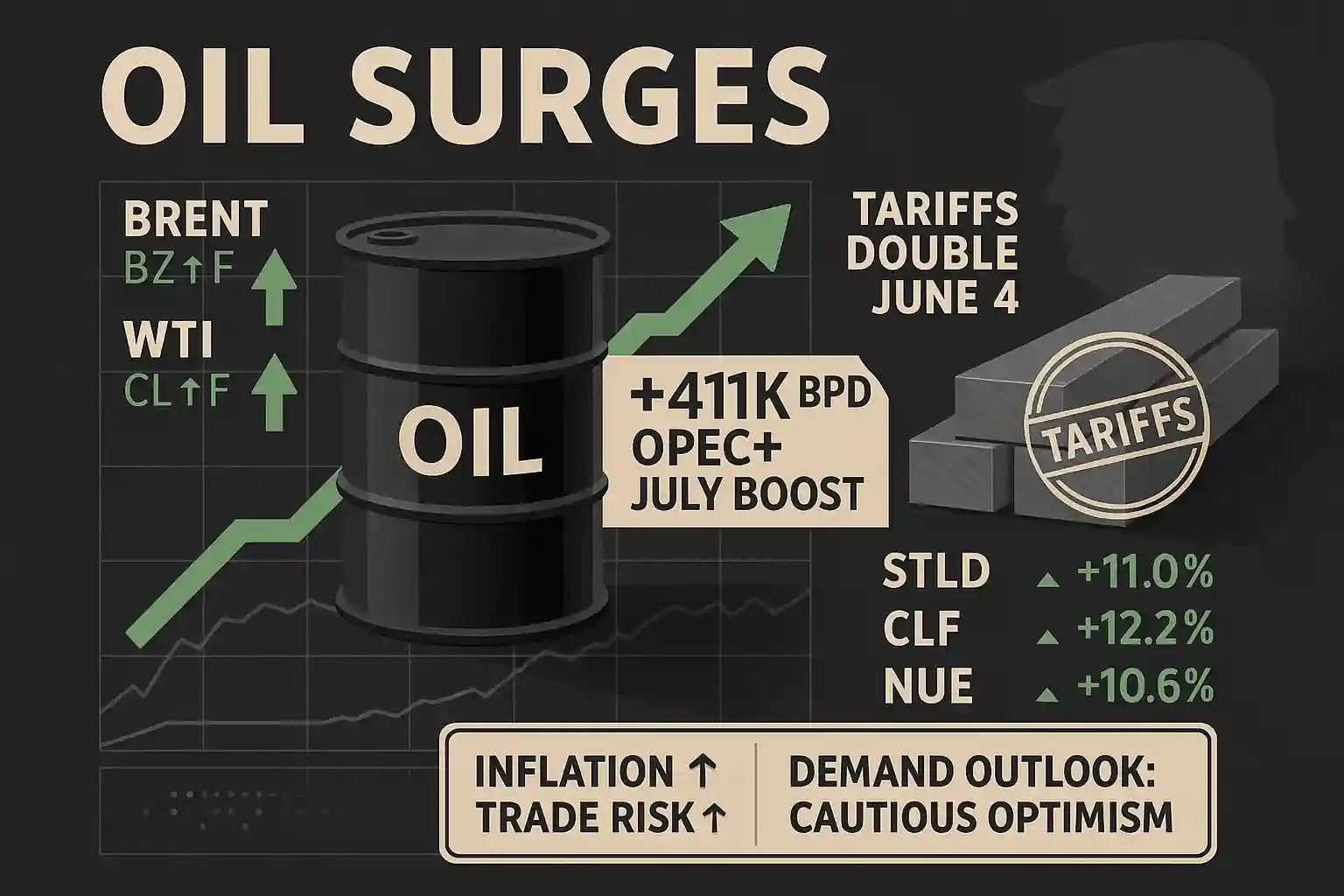

Oil prices soared on Thursday following an announcement that OPEC+ will increase production by 411,000 barrels per day in July. This surprise move signals the group’s confidence in rising demand and attempts to stabilize global oil supply.

Brent crude (BZ=F) and West Texas Intermediate (CL=F) both moved sharply higher in early trading, reflecting growing optimism across energy markets.

Trump’s steel tariffs shake markets and boost oil

Oil’s rally came in tandem with another major policy headline: President Donald Trump’s decision to double tariffs on imported steel and aluminum starting June 4. This move sent U.S. steel stocks soaring, but also added uncertainty to global trade dynamics — a factor closely tied to energy demand.

As oil markets are highly sensitive to macroeconomic developments, the news of heightened trade barriers brought new attention to the energy sector’s exposure to geopolitical risks.

Oil market reacts to OPEC+ strategy shift

The oil market has closely monitored OPEC+ actions since early 2024. This latest output hike signals a strategic pivot to ensure stable pricing amid global demand growth. While some analysts had expected a pause, the increase suggests confidence in near-term economic activity, particularly in Asia.

Oil remains a barometer for global trade sentiment, and Thursday’s price action confirmed investor enthusiasm for energy equities and commodities.

Oil prices driven by supply and policy factors

The rise in oil prices is not solely due to OPEC+ output decisions. Trump’s aggressive trade stance introduces new inflation risks, which often lift commodity prices like oil. As tariffs increase costs in steel and aluminum, downstream impacts can ripple across the manufacturing and energy sectors.

Oil investors see these signals as bullish, with short-term supply-demand dynamics tightening further in Q3.

Steel and oil: a tandem market surge

While oil prices climbed, U.S. steel producers also saw a sharp boost. Steel Dynamics (STLD), Cleveland-Cliffs (CLF), and Nucor (NUE) all posted double-digit gains after the White House confirmed the tariff escalation.

The tandem rise in oil and steel reflects investor anticipation of domestic manufacturing strength — but also inflationary pressures.

Oil outlook remains bullish but fragile

With the oil keyword at the center of today’s market narrative, analysts caution that volatility remains high. Supply-side optimism is tempered by ongoing geopolitical uncertainty and potential demand shocks if tariffs escalate further.

Still, oil’s role as an inflation hedge and a trade-sensitive asset keeps it in focus for energy investors.