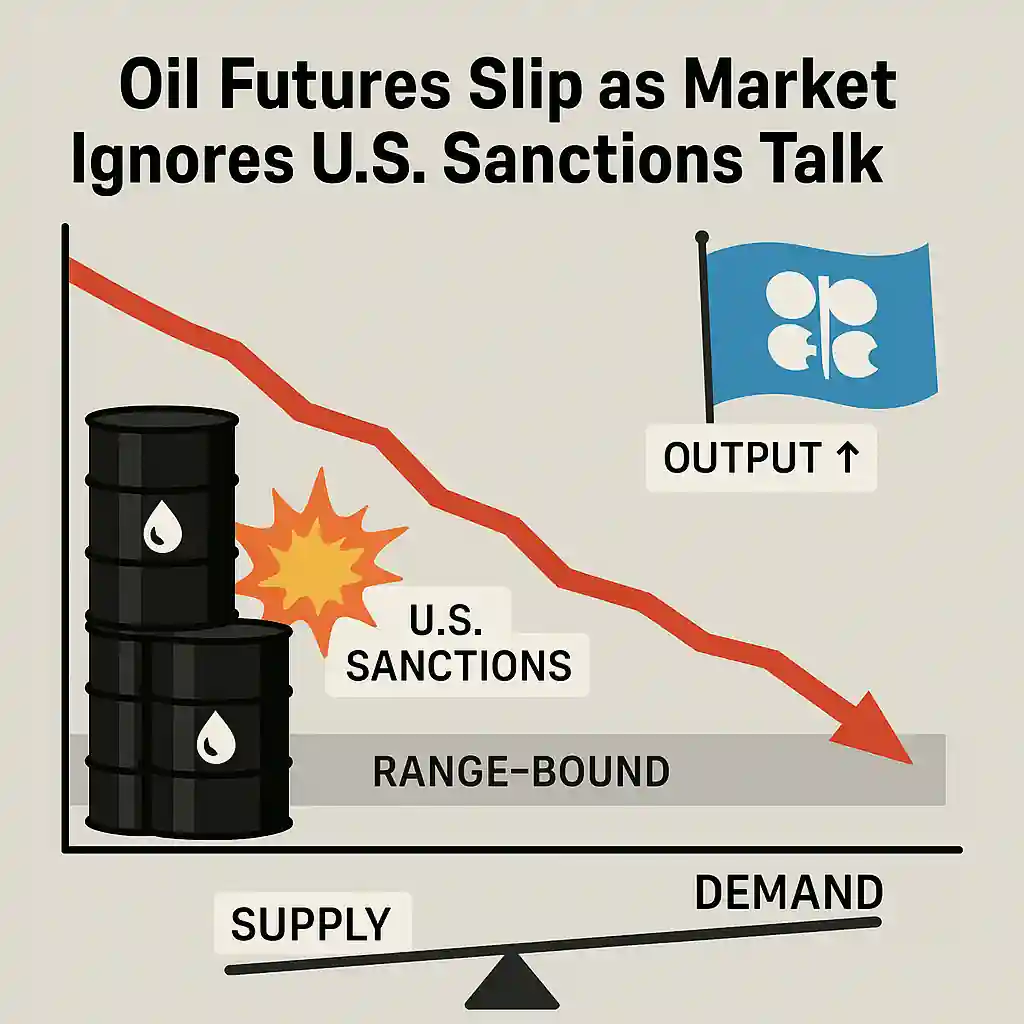

Oil Futures Slip as Market Ignores U.S. Sanctions Talk

Oil futures are down as traders look past U.S. threats of new sanctions on Russia. Despite heightened political tension, the oil market remains focused on fundamentals. The lack of immediate supply disruption keeps oil prices under pressure.

OPEC+ Production Hike Adds Bearish Weight

The market is increasingly turning its attention to OPEC+. A new round of production hikes is expected, which could flood the market with additional oil. With demand growth uncertain, this raises concerns about oversupply in the second half of the year.

Geopolitical Risks No Longer Driving Oil Prices

Although geopolitical risks traditionally support oil, today’s traders appear less reactive. U.S. threats of sanctions against Russia haven’t sparked a price rally. Markets seem confident that Russian oil flows will continue despite political pressure.

Supply Expectations Outweigh Conflict Premium

Higher expected output from OPEC+ is now seen as a more influential factor than diplomatic threats. Traders are pricing in the potential return of barrels previously held back. As supply expands, oil prices are finding it harder to maintain any upward momentum.

Sanctions Threat Lacks Immediate Supply Impact

Unlike past conflicts, recent sanctions rhetoric hasn’t caused disruptions. Russian oil has continued to flow through global markets, albeit with some rerouting. As long as supply chains remain intact, oil prices may not respond dramatically to policy announcements.

Market Sentiment Turns Cautious on Oil

With the combination of growing output and waning geopolitical risk pricing, oil sentiment is subdued. Futures markets reflect this view, with traders positioning for a potential surplus rather than a shortfall. The outlook remains neutral to bearish for now.

Oil May Remain Range-Bound Without Fresh Catalysts

Unless a significant new supply disruption emerges, oil futures are likely to stay in a narrow band. Traders await concrete data—either on OPEC+ compliance, demand trends, or inventory reports—before adjusting positions. For now, oil lacks a bullish catalyst.

Outlook Hinges on Supply Discipline and Demand Growth

Moving forward, oil’s direction will depend on whether OPEC+ manages to balance rising production with global demand. If growth falters or quotas are breached, prices may fall further. Conversely, any unexpected cut or disruption could lift oil quickly.