Wall Street Banks Raise Oil Price Targets

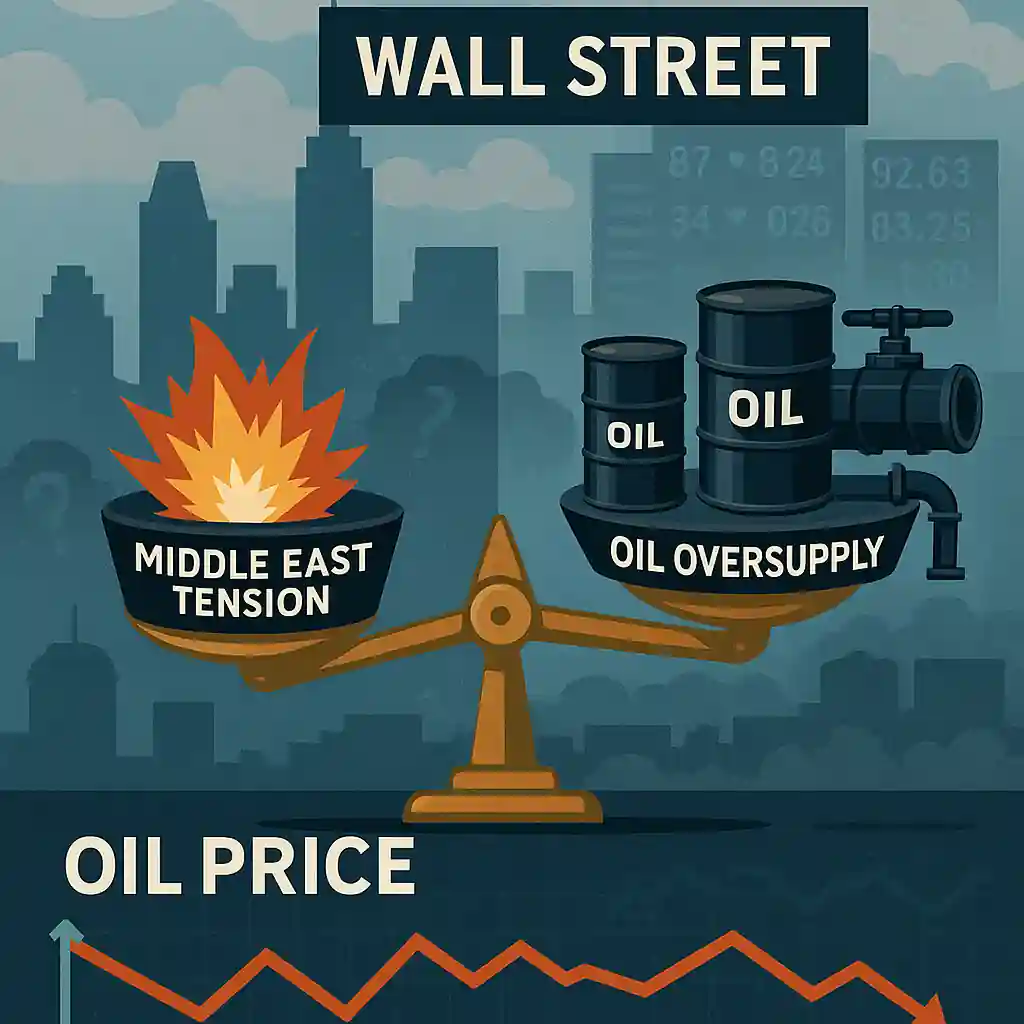

Major Wall Street banks have slightly increased their oil price forecasts. The revision comes after rising geopolitical tensions in the Middle East, a region that plays a critical role in global oil supply. Analysts cite increased uncertainty as a factor supporting oil in the short term.

Despite this modest upward adjustment, oil markets remain fragile due to structural supply and demand concerns.

Geopolitical Tensions Support Oil Prices

The renewed conflict in the Middle East has reintroduced risk premiums to the oil market. Investors worry that escalations involving key producers could disrupt oil flows. While no major supply routes have been affected yet, the mere threat has been enough to influence oil prices.

Historically, similar tensions have triggered short-term oil price spikes followed by corrections.

Supply Glut Pressures Oil Outlook

Concerns about a global oversupply of oil are limiting price gains. Production increases in the U.S., OPEC+, and non-OPEC countries continue to weigh on the market. Some analysts argue that the world is producing more oil than it currently consumes.

This imbalance remains a key factor suppressing oil prices despite geopolitical risks.

Demand Uncertainty Clouds Oil Market

Global oil demand remains unpredictable. Economic growth in China is weaker than expected, while Europe faces stagnation. Even in the U.S., signs of slowing industrial activity have added to concerns about future oil consumption.

Traders are reluctant to drive oil prices higher without stronger demand indicators.

Mixed Signals Keep Oil in Tight Range

Oil markets are caught between conflicting forces. On one side, geopolitical tensions could tighten supply. On the other, oversupply and demand weakness weigh heavily. This tug-of-war keeps oil prices range-bound, with no clear breakout in sight.

Volatility is likely to persist as traders respond to new data and developments.

Long-Term Oil Outlook Still Unclear

Analysts note that while short-term oil movements respond to headlines, the long-term outlook depends on sustained supply discipline and demand recovery. Without both, any price surge in oil may be short-lived.

For now, oil remains a volatile asset, driven by both fundamentals and news flow.

Oil Market Awaits Further Signals

Market participants are now focused on upcoming OPEC+ meetings and inventory data releases. These events could provide clearer direction for oil. Until then, oil prices may continue to drift within a narrow band.

The path forward for oil will depend on whether fundamentals or geopolitics take control in the weeks ahead.