NASDAQ: Red Robin surprises with strong Q1 profits

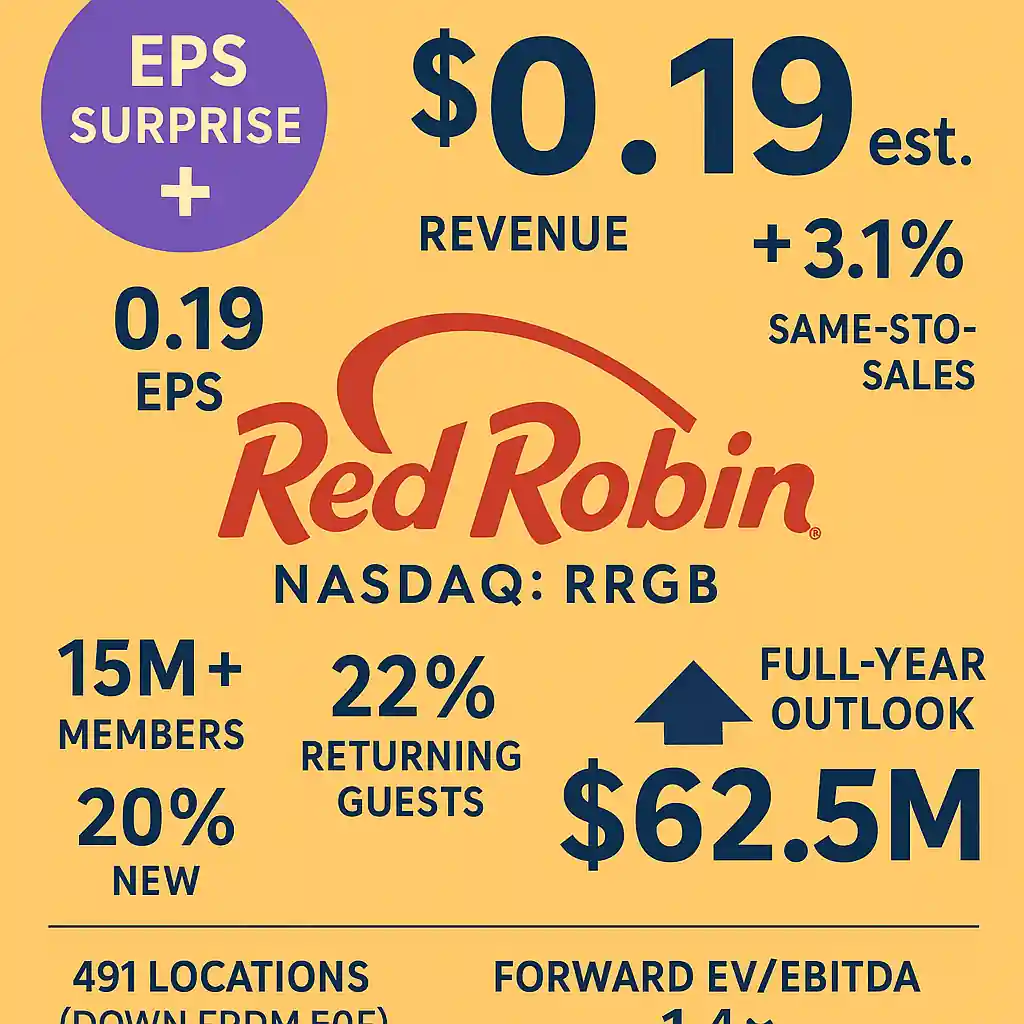

Red Robin (NASDAQ:RRGB) posted a surprising profit in Q1 CY2025, despite flat revenue of $392.4 million. The non-GAAP EPS of $0.19 crushed analyst expectations of a $0.49 loss. This significant earnings beat lifted sentiment around the NASDAQ-listed burger chain.

Adjusted operating income also topped forecasts, reaching $9.06 million, driven by operational efficiency and improved guest experience initiatives.

NASDAQ stock gains despite traffic headwinds

Though Red Robin saw year-over-year sales remain unchanged, the NASDAQ-listed stock’s profit came from cost controls and menu price hikes. Same-store sales rose 3.1%, reversing last year’s 6.5% decline. However, foot traffic still lagged.

The company ended the quarter with 491 locations, down from 505 last year. Still, management remains optimistic about growth in guest engagement and profitability.

Red Robin’s cost strategy supports NASDAQ outlook

Labor efficiencies and disciplined pricing were key to the results. According to CFO Todd Wilson, these savings were achieved without hurting guest satisfaction.

The success of the loyalty program — now with over 15 million members — helped offset lower traffic. About 22% of visits came from returning guests, while 20% were new.

NASDAQ investors watch for turnaround momentum

Red Robin raised full-year EBITDA guidance to $62.5 million, above analyst expectations. This gives NASDAQ investors a reason to reconsider the stock, especially as its market cap stands at just under $90 million.

Despite a drop in total locations, Red Robin plans to optimize its network by closing 10–15 underperforming sites. Management is also selling owned properties to reduce debt.

NASDAQ: Red Robin leans into loyalty and branding

New CEO Dave Pace emphasized guest experience and strategic marketing as top priorities. Russ Klein, the new marketing chief, is set to lead Red Robin’s brand refresh.

Red Robin’s loyalty program will remain central to efforts aimed at driving traffic. No new price hikes are planned in 2025 — instead, the company will absorb cost pressures with efficiency gains.

Tariffs and inflation test NASDAQ restaurant stocks

Red Robin’s strategy includes maintaining margins while managing external challenges like tariffs and inflation. This reflects a trend across NASDAQ-listed restaurants, where cost discipline is vital to preserve profitability.

The company’s willingness to forgo more price hikes is meant to preserve value perception among customers and maintain a competitive edge.

Will NASDAQ reward Red Robin’s disciplined growth?

Investors will now track how Red Robin balances cost discipline with growth. Key indicators include traffic trends, loyalty program engagement, and store optimization.

At a forward EV/EBITDA of 1.4×, the NASDAQ-traded stock may attract value investors. Red Robin’s earnings surprise and raised guidance show its turnaround plan is gaining traction.