MicroStrategy Leads the Pack in Bitcoin Holdings

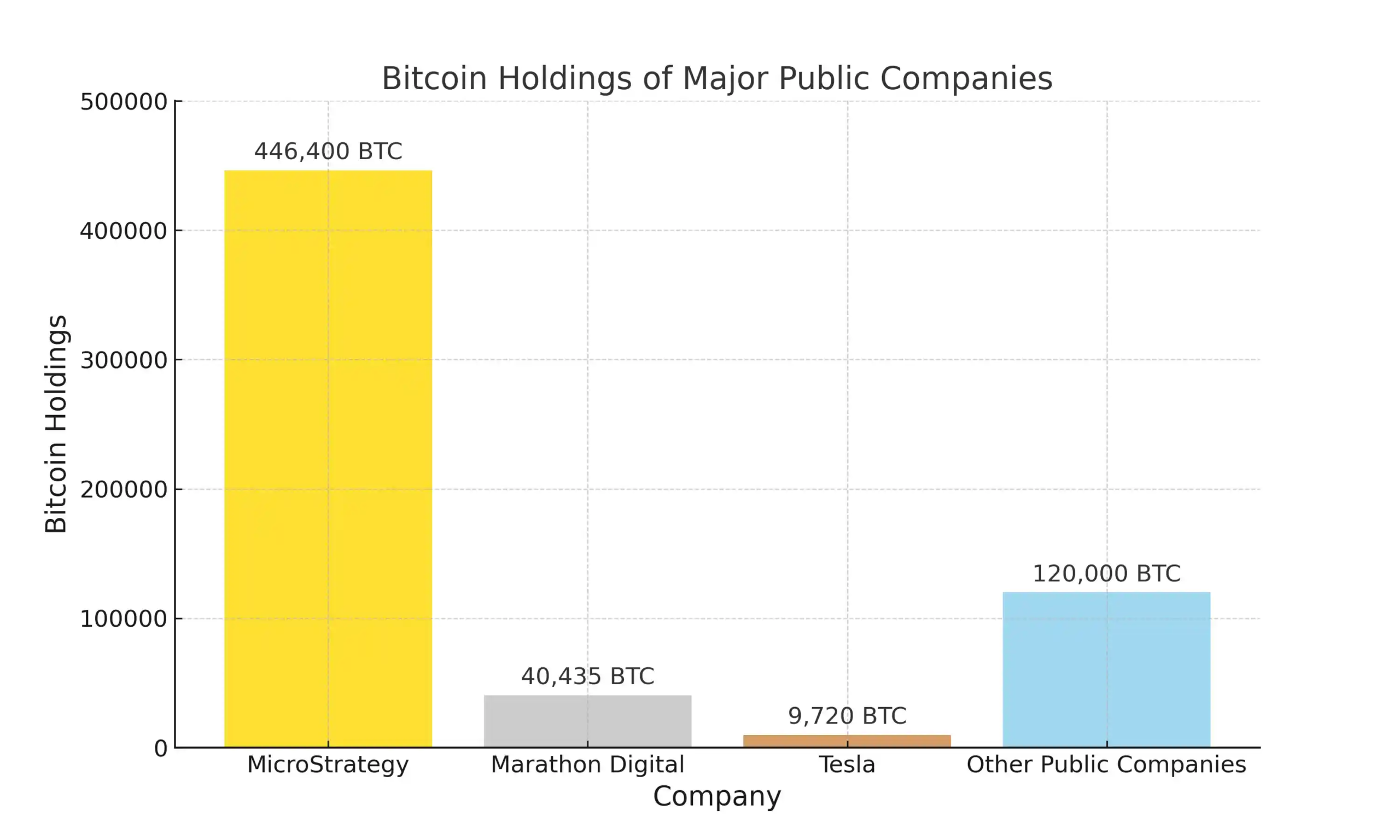

MicroStrategy (NASDAQ: MSTR) has taken an unparalleled position in the Bitcoin market, owning 446,400 coins as of December 31, 2024. This makes it the largest corporate holder of Bitcoin, dwarfing other public companies. Marathon Digital, a crypto mining company, ranks second with 40,435 Bitcoins, while Tesla holds 9,720 coins.

A $42 Billion Plan to Buy More Bitcoin

The company’s bullish stance on Bitcoin doesn’t stop there. MicroStrategy plans to raise $42 billion over the next three years to increase its Bitcoin holdings further. This aggressive approach reflects the company’s unwavering belief in Bitcoin as a long-term asset, guided by co-founder Michael Saylor’s famous mantra: “Every day is a good day to buy Bitcoin.”

Volatility and Risk Define MicroStrategy’s Strategy

Unlike other companies that use Bitcoin to diversify their portfolios, MicroStrategy has essentially transformed itself into a Bitcoin holding entity. While its traditional enterprise software business remains, its financial success in 2024 was entirely driven by Bitcoin’s meteoric rise. This strategy propelled MicroStrategy’s stock price by 370% over the past year, but it also exposes the company to extreme volatility.

Fundamentals Take a Back Seat

MicroStrategy’s core business generates less than $500 million in annual revenue, with declining sales and no profitability. The company’s $75 billion market cap is driven almost entirely by its Bitcoin holdings rather than its enterprise software performance. Investors should be cautious, as this stock’s valuation lacks traditional fundamentals and is deeply tied to Bitcoin’s performance.

Who Should Consider Investing in MicroStrategy?

For investors who believe in Bitcoin’s long-term potential and can tolerate high levels of risk, MicroStrategy offers a way to gain exposure to the cryptocurrency market. However, those seeking stability and strong fundamentals might want to look elsewhere.

The Outlook for Bitcoin and MicroStrategy

With Bitcoin’s path influenced by government regulations, retail investor sentiment, and macroeconomic factors, MicroStrategy’s future is inextricably linked to the cryptocurrency’s price. While the company’s bold strategy paid off in 2024, its reliance on Bitcoin makes it a speculative investment option, suitable only for those with a high risk tolerance and strong belief in the crypto market’s future.