Gold prices rise amid rising tariffs and slowing growth

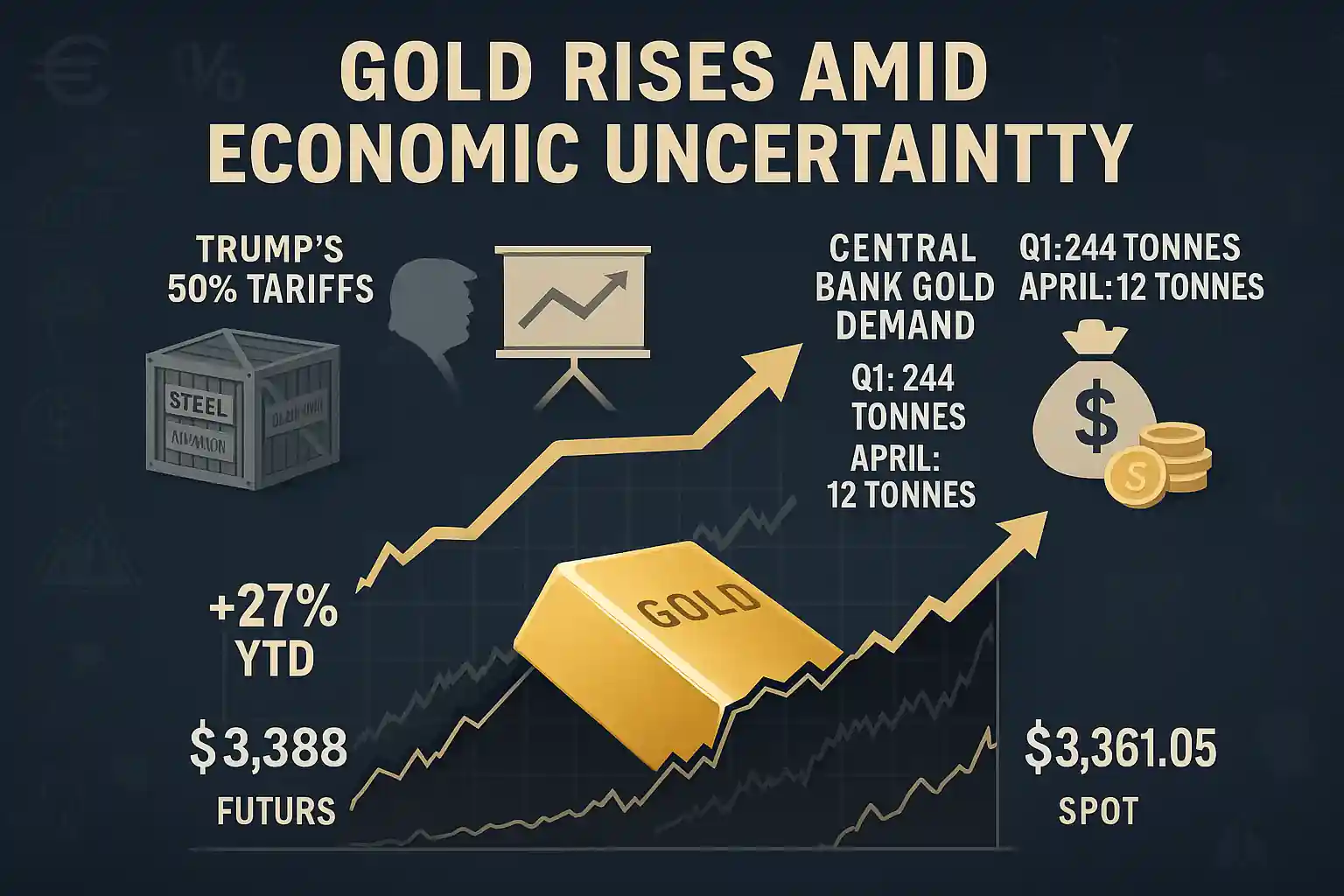

Gold prices edged higher on Wednesday, continuing a bullish streak fueled by growing fears over U.S. tariffs and global economic weakness. Gold futures climbed 0.3% to $3,388 per ounce, while spot gold rose 0.2% to $3,361.05 per ounce.

The move comes as investors seek safe-haven assets, with gold continuing to act as a hedge against mounting geopolitical and economic uncertainty.

Trump’s tariff move fuels gold demand

President Donald Trump’s latest trade maneuver — doubling steel and aluminium tariffs to 50% — took effect overnight, shaking global markets. While the U.K. received a temporary exemption, the tariff increase is heightening investor anxiety.

Trump further intensified tensions with China, calling it “extremely hard” to strike a trade deal with President Xi Jinping. These statements, paired with Beijing’s vow to defend its interests, have pushed investors toward gold, traditionally seen as a store of value during economic volatility.

OECD cuts growth outlook, supports gold rally

Gold’s upward momentum was further reinforced by a downgraded global economic forecast from the Organisation for Economic Cooperation and Development (OECD). The OECD now expects global GDP to grow just 2.9% in both 2025 and 2026, down from 3.3% in 2024.

The OECD cited a “challenging” global landscape, shaped by protectionist trade measures and slowing demand — all bullish indicators for gold prices.

Central banks keep buying gold, but at slower pace

A key factor in gold‘s sustained rally has been robust demand from central banks. According to ING’s Warren Patterson and Ewa Manthey, gold prices are already up 27% in 2025. In Q1 alone, central banks purchased 244 tonnes of gold.

However, the World Gold Council reported a slowdown in April, with central banks adding just 12 tonnes — well below the 12-month average of 28 tonnes. While the pace is slowing, central banks remain net buyers, reflecting continued diversification away from the U.S. dollar.

Gold remains a hedge in turbulent times

Despite fewer central bank purchases, gold demand remains high due to persistent geopolitical risks and uncertain economic policy. Analysts suggest that gold will stay in favor as global tensions rise and traditional markets face increased volatility.

With inflation pressures, slowing trade, and unpredictable leadership in key economies, gold is likely to remain a preferred asset class in investor portfolios.