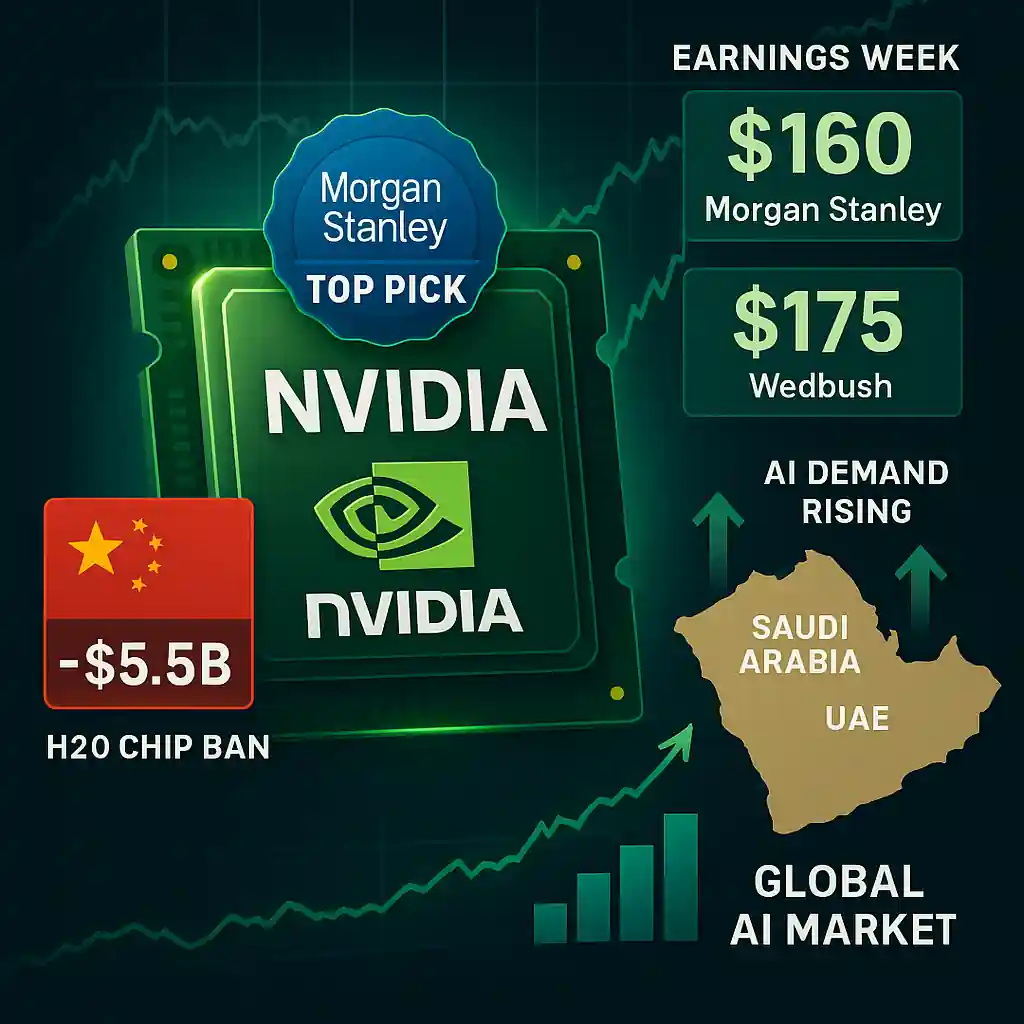

Nvidia named top semiconductor pick by Morgan Stanley

Nvidia was named Morgan Stanley’s “top pick” among semiconductor stocks on Tuesday, just ahead of its highly anticipated earnings report. Despite short-term concerns over China sales, analysts remain bullish on Nvidia’s long-term AI growth story.

The bank maintained its “overweight” rating and a $160 price target—22% above last week’s closing price.

Nvidia faces $5.5B hit from China chip ban

The optimism comes as Nvidia braces for a $5.5 billion charge tied to Trump administration export controls. These new rules restrict the sale of Nvidia‘s H20 AI chips to China, one of its key markets.

However, Morgan Stanley believes the headwinds are “well telegraphed,” suggesting the market has already priced in the China risk.

Middle East demand may offset China shortfall

Analysts at Wedbush Securities argue that Nvidia could quickly replace lost Chinese revenue with soaring AI investment from the Middle East.

Recent deals in Saudi Arabia and the UAE could significantly boost demand. Saudi’s AI startup Humain has agreed to purchase chips from Nvidia, and a UAE deal to import advanced American-made chips is reportedly in progress.

Wedbush sees Nvidia as AI market growth driver

Wedbush set a bullish $175 price target for Nvidia, citing its key role in the expanding $1 trillion global AI market. The firm expects that AI infrastructure spending in the Gulf region could “fill the void” left by China in Nvidia’s business pipeline.

This reinforces the narrative that Nvidia is not just a chipmaker—but a key player in the future of global AI development.

Analysts focus on second-half Nvidia rebound

Morgan Stanley’s note emphasized that the firm is “not buying the stock for the quarter explicitly.” Instead, analysts are looking at the second half of the year, when they expect AI-driven revenue acceleration to resume.

For Nvidia investors, this shift from near-term caution to long-term confidence could be the key story moving forward.

Nvidia stock poised for further upside

The analyst consensus, as tracked by Visible Alpha, approaches a $164 price target—below Wedbush’s $175, but still reflecting upside potential.

With the stock already rebounding from early 2025 volatility, new catalysts in the Middle East, ongoing AI investments, and stronger enterprise demand could power further gains for Nvidia.

Nvidia earnings report may set near-term tone

With earnings due this week, investors will be looking for updates on China-related losses, Middle East deal progress, and AI chip sales. Even a modest beat could fuel renewed momentum, especially if Nvidia raises its outlook or highlights further strategic partnerships.

Whether short-term pressure lingers or fades will likely depend on the narrative Nvidia delivers in its earnings call.