Federal Reserve signals caution amid Trump tariffs

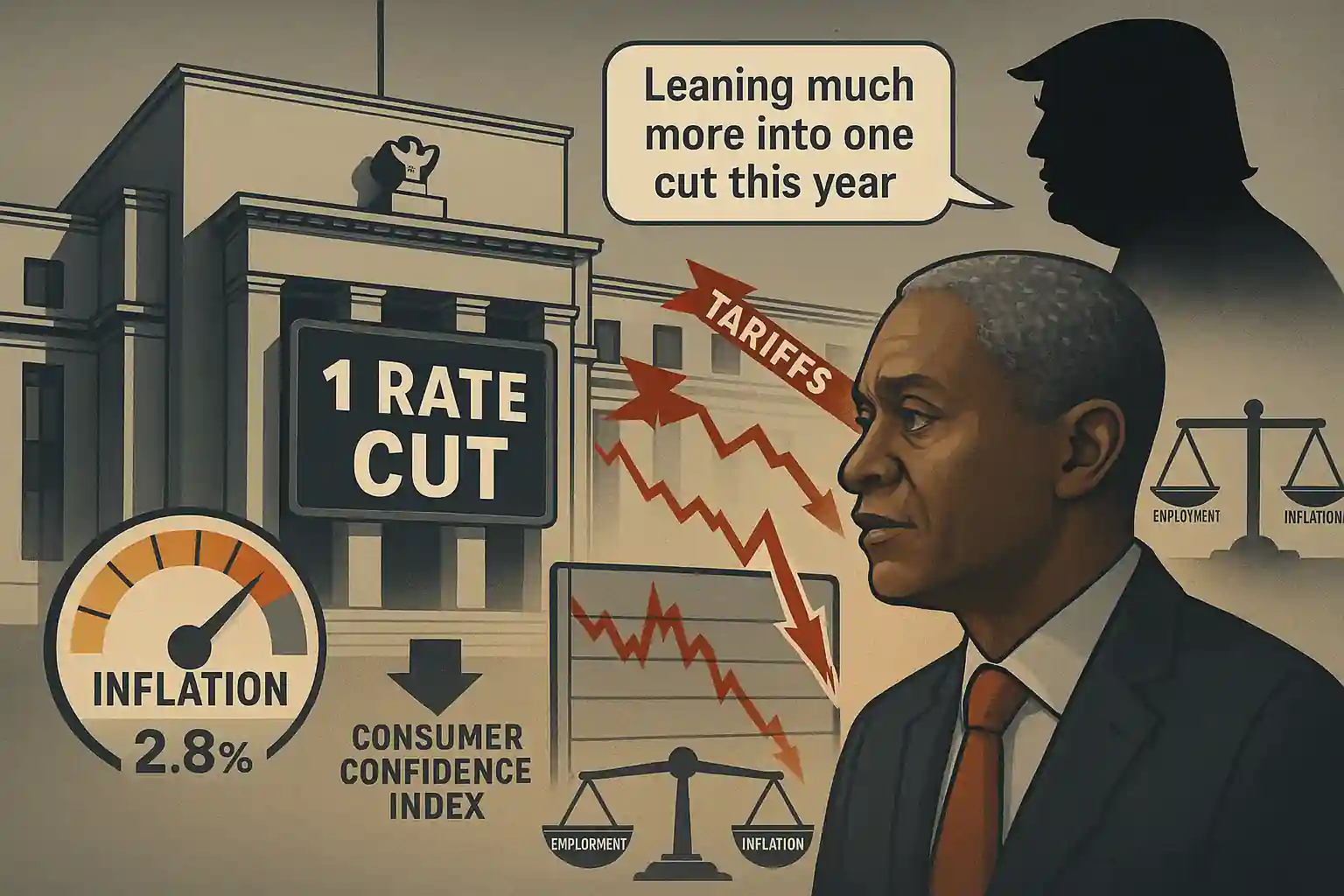

A leading Federal Reserve official said Monday that the central bank should cut interest rates just once in 2025. The move would allow time to evaluate the full economic fallout from President Trump’s sweeping tariffs.

Atlanta Fed President Raphael Bostic explained on CNBC that the Federal Reserve needs patience to assess the damage before taking further action.

Bostic pulls back from earlier Fed cut forecast

Bostic had previously anticipated two rate cuts in 2025. However, in light of escalating trade tensions, he now favors a more conservative approach. “I’m leaning much more into one cut this year,” he said.

He stressed that it could take six months to fully understand how Trump’s tariffs will ripple through the economy, inflation, and employment.

Trump’s tariffs inject uncertainty into Fed policy

The Federal Reserve is currently holding interest rates steady at 4.25% to 4.5%. The latest round of tariffs from Trump’s administration has complicated the Fed’s mandate to maintain low inflation and maximum employment.

Bostic said the trade landscape is too unpredictable to plan additional cuts until the effects are clearer.

Federal Reserve monitors inflation expectations closely

Bostic highlighted one growing concern: inflation expectations. According to Atlanta Federal Reserve data, firms now expect 2.8% inflation over the next year, up 0.3%.

“I worry a lot about the inflation side,” Bostic said. These expectations could force the Fed to remain cautious, even as other economic indicators weaken.

Tariffs dent consumer confidence and growth

Trump’s aggressive tariffs have not only impacted trade but also consumer sentiment. A key confidence index has declined for five straight months, reaching its second-lowest level ever.

Americans are growing more concerned about their financial future, creating more pressure on the Federal Reserve to carefully calibrate its policy response.

One optimistic scenario for the Federal Reserve

Bostic did outline a potential upside. If Trump negotiates successful trade deals that reduce tariffs quickly, the economy could rebound faster than expected.

In that case, the Federal Reserve might not need to make additional rate cuts. However, Bostic cautioned that such a scenario remains speculative.

Federal Reserve to stay flexible in uncertain year

While Bostic does not vote on rate decisions, his insights carry weight within the Federal Reserve system. His latest comments reflect a broader mood of caution inside the Fed.

For now, the central bank appears prepared to act—but not overreact. One rate cut may be all the Federal Reserve delivers in 2025 unless new data forces its hand.