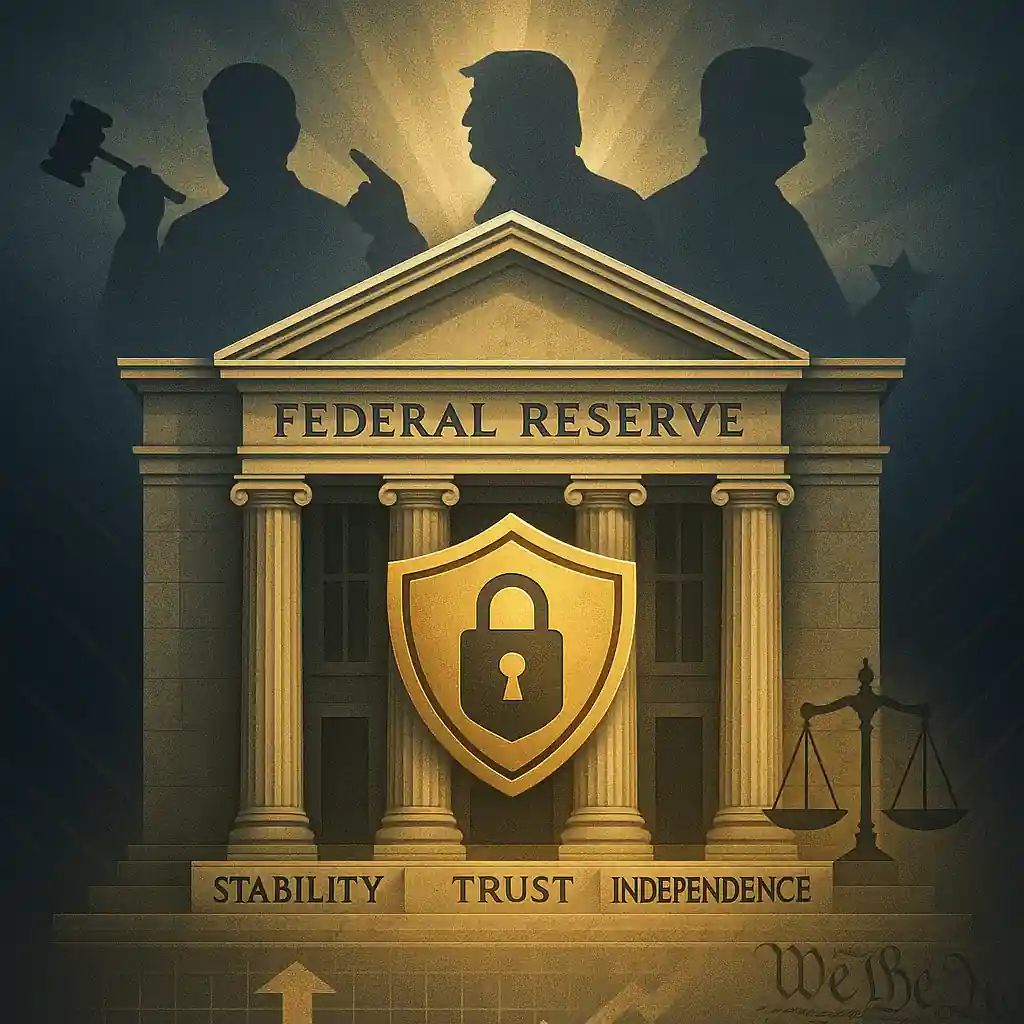

Fed’s governance model defends stability and trust

The Fed’s structure has helped anchor U.S. economic stability, according to Fed Governor Christopher Waller. Speaking at Stanford University, Waller said the design of the Federal Reserve’s Board of Governors “has stood the test of time.”

He argued that the Fed’s independence from political pressure is central to delivering consistent and objective policy outcomes over time.

Fed terms shield policy from political interference

Unlike typical government agencies, Fed governors serve 14-year terms and cannot be dismissed over policy disagreements. Waller emphasized this as a strength, not a flaw.

The Fed’s system, he said, lets each U.S. president influence the board by nominating some members, while ensuring no administration can dominate it completely. This mix of accountability and independence improves long-term results.

Fed model linked to lower inflation and volatility

Waller noted that research shows the Fed’s structure has historically helped reduce inflation and economic volatility. Decisions made by governors who can’t be fired create an environment focused on data, not politics.

By shielding policymakers from short-term political pressure, the Fed can pursue stable, non-partisan strategies. This has become especially important as markets look for consistency amid changing administrations.

Fed’s independence challenged during Trump era

Tensions between the White House and the Fed have intensified in recent years. During Donald Trump’s presidency, he openly criticized Fed Chair Jerome Powell and even hinted at removing him.

Though Trump later backed away from those threats, the situation raised alarm over the Fed’s autonomy. Waller’s remarks appear to reinforce the value of institutional protection in light of that experience.

Fed structure under legal spotlight

A U.S. Supreme Court case could reshape how presidents interact with independent agencies. If the Court rules that Trump—or any president—can remove officials from other independent bodies, the Fed may be next in line.

Waller didn’t comment on the legal case directly, but his defense of the current Fed structure speaks volumes. Many analysts view this independence as essential to the credibility of U.S. monetary policy.

No comment on Fed policy, but message was clear

Waller refrained from discussing interest rates or inflation in his remarks. Instead, he focused on the governance framework that enables the Fed to function without political interference.

His speech was well-received at the Hoover Institution, known for promoting free-market policies. It sent a clear message: the Fed must remain independent to fulfill its mission.

Fed’s legacy of independence may face new tests

With rising scrutiny on central banks worldwide, the Fed may face pressure to adapt. But Waller made it clear—any change that compromises the Fed’s independence could harm the economy.

As political tensions rise and legal battles unfold, the coming years may test whether the Fed can maintain its non-partisan foundation. For now, Waller believes its record speaks for itself.