Dave Ramsey’s practical guide to raising money-smart kids

Dave Ramsey, the renowned personal finance expert and host of The Ramsey Show, recently shared a powerful message on teaching kids about money.

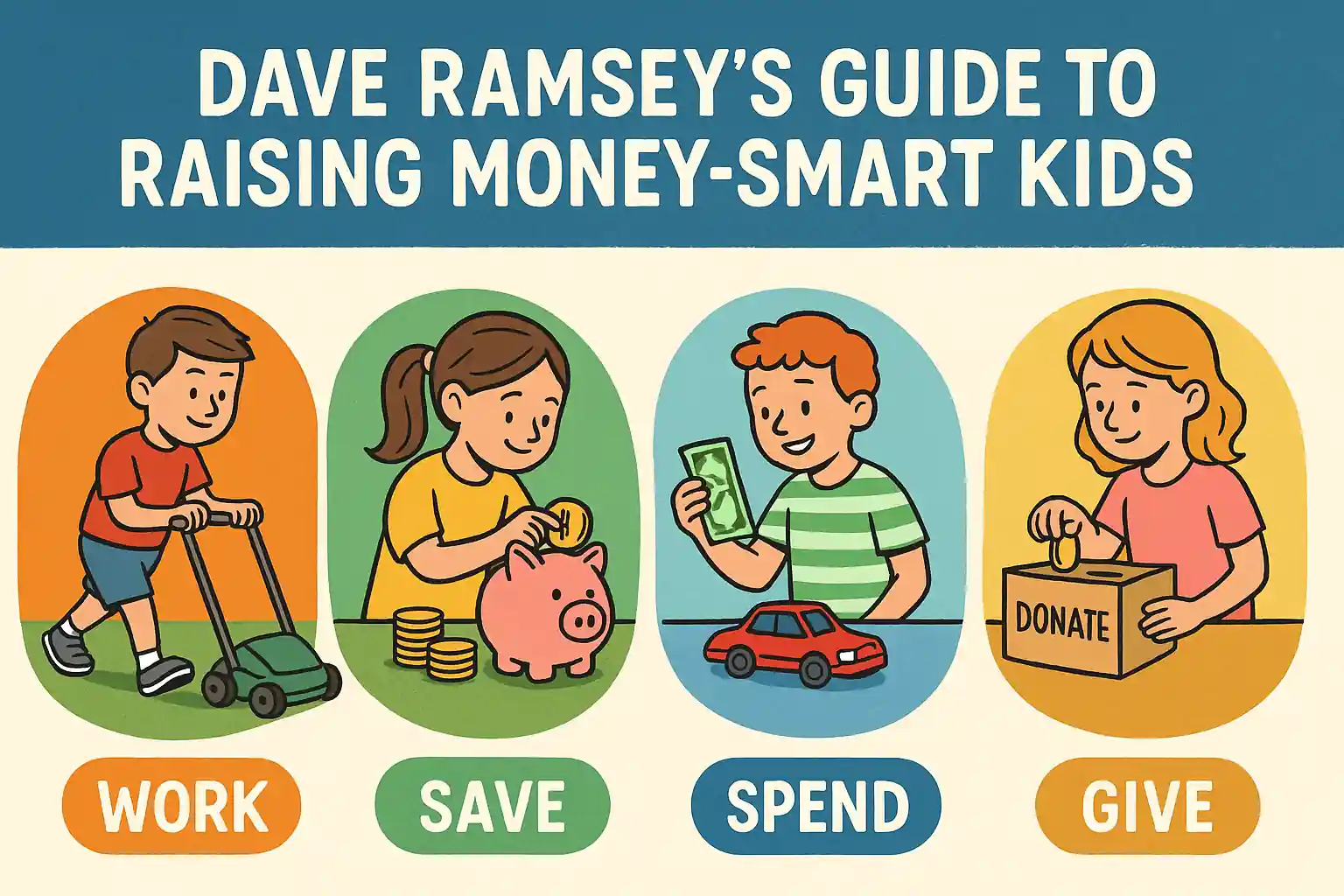

In a viral Instagram post, Dave Ramsey outlined four key principles children should learn: work, save, spend, and give.

By focusing on these areas early, parents can set their children on the path to lifelong financial success.

Work: The foundation of financial understanding

According to Dave Ramsey, one of the most important lessons is that “money comes from work, not from other people, the government or dumb luck.”

He encourages parents to move away from traditional allowances. Instead, implement commission-based chores where kids get paid based on the work they complete.

This helps them connect effort with income and promotes responsibility and independence—key values Dave Ramsey emphasizes in all his teachings.

Save: Build patience and smart money habits

Saving is a discipline, and Dave Ramsey believes it’s critical to start young.

“If they learn how to save for a Barbie today, they’ll know how to save for a car tomorrow—with no debt,” he says.

Setting simple savings goals teaches kids patience and delayed gratification. Even small amounts matter, as they help establish the lifelong habit of not spending everything you earn.

Spend: Teach balance, not restriction

Spending money is part of the reward of hard work, and Dave Ramsey warns against forcing children to save every penny.

If kids are never allowed to spend, they might rebel later with poor money habits. Instead, teach them to budget using the envelope system.

Divide income into labeled envelopes for spending, saving, and giving. Once their spending envelope is empty, they must earn more—instilling financial discipline and control.

Give: Instill values beyond money

Though not included in this specific post, Dave Ramsey frequently promotes giving as a critical financial habit.

Encouraging kids to give a portion of their earnings to causes they care about teaches empathy and generosity—values that reinforce responsible money management.

The habit of giving helps children understand that money is a tool, not just a goal.

Dave Ramsey’s approach builds lifelong habits

By integrating these four principles—work, save, spend, and give—Dave Ramsey offers a holistic model for teaching kids about money.

These lessons go beyond theory. They’re simple, practical, and aligned with how real financial systems work.

Parents who follow Dave Ramsey’s methods can give their children a solid foundation for financial independence—without debt and with purpose.