Strategy sets the standard for public crypto treasuries

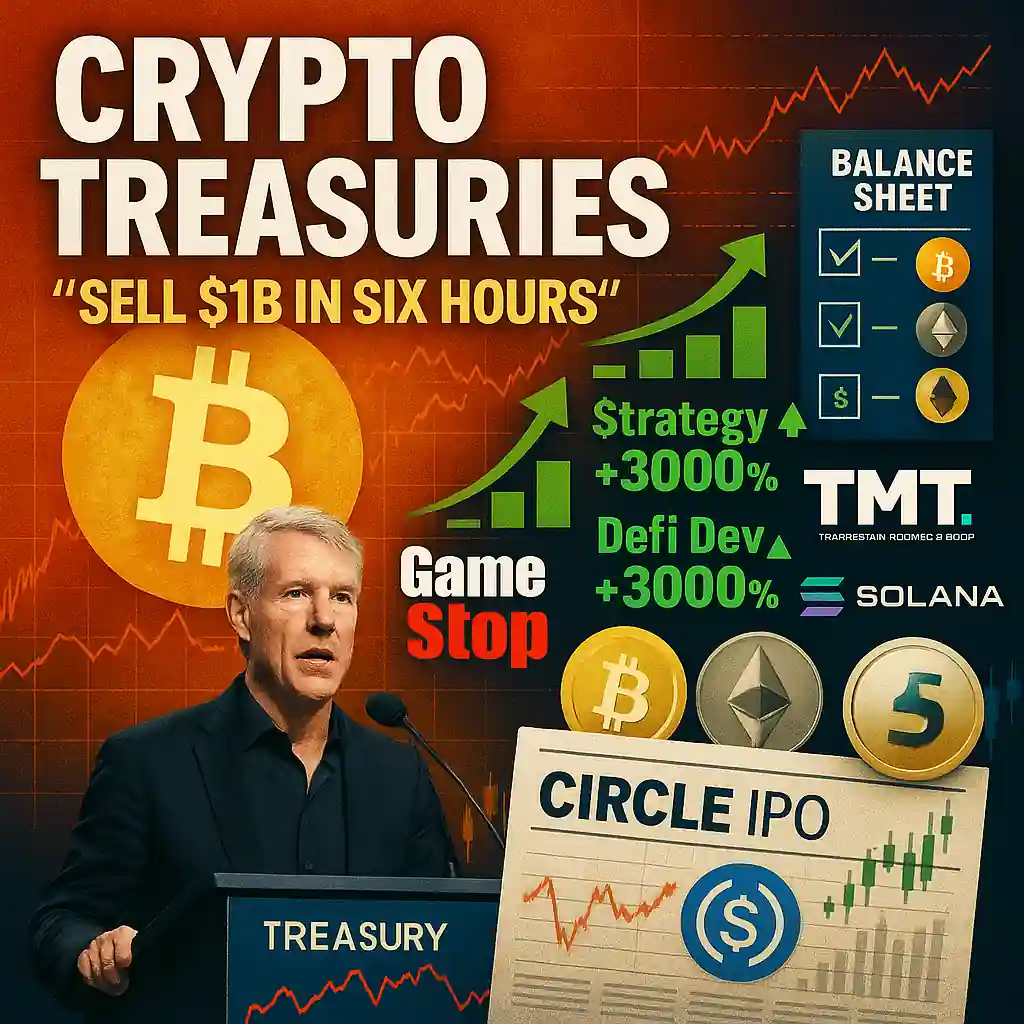

In 2025, crypto treasuries are the hottest trend on Wall Street. Public companies are racing to copy Michael Saylor’s Strategy, which holds over 5% of all Bitcoin. With Strategy’s stock up nearly 3,000% in five years, firms see a clear path: buy crypto, hold it, and watch shares soar.

Saylor’s keynote at Bitcoin 2025 in Las Vegas underscored the trend. “When you’re at the top of U.S. capital markets, you can sell $1B of securities in six hours,” he said.

Trump, GameStop, and Solana join the treasury wave

The crypto treasury movement is expanding beyond Bitcoin. Trump’s media firm plans to add crypto, and GameStop just bought $500M in Bitcoin. SharpLink is aligning with Ethereum. Meanwhile, Defi Dev Corp. became the first Solana treasury play, sending its shares up 3,000%.

Pantera Capital likened this to Strategy’s early days and placed a $50M bet on Defi Dev Corp. “If Solana is next, the addressable market is $5B,” said Pantera’s Comso Jiang.

Circle IPO could supercharge crypto legitimacy

All eyes are on crypto stablecoin issuer Circle, preparing for one of the biggest IPOs in recent memory. Circle, which issues USDC, just raised its share price range to $27–$28 and seeks a $7B valuation.

The timing is perfect. Congress is advancing a stablecoin bill, with bipartisan momentum. Even if the law isn’t passed immediately, Circle’s public debut should stoke investor confidence in crypto infrastructure.

Crypto’s ‘Wynn’ and the rise of influencer trading

In parallel, crypto Twitter is abuzz with trader James Wynn. Known for leveraged mega-trades, Wynn turned a $4M position into $100M—before losing $17.5M. He’s called out major players like Binance’s CZ and rallied followers to donate USDC to support his trades.

While some suspect a marketing ploy for trading platform HyperLiquid, it highlights how social media and spectacle continue shaping crypto market narratives.

From fringe to front page

Just years ago, crypto was the outsider asset. Now it’s on public balance sheets, part of IPO roadshows, and championed by former U.S. presidents. With major firms holding Bitcoin, Ethereum, and Solana as treasury assets, this trend shows no signs of slowing.

Even though Strategy still trades at a premium others haven’t achieved, the appeal of riding crypto price momentum using equity markets is transforming how companies approach capital.

As more firms turn to crypto as a balance sheet strategy, the asset class inches closer to full financial system integration.