Price Isn’t Everything in Crypto Investing

For seasoned analysts, watching crypto prices alone is no longer enough. Tongtong Gong, COO of Amberdata, puts it plainly:

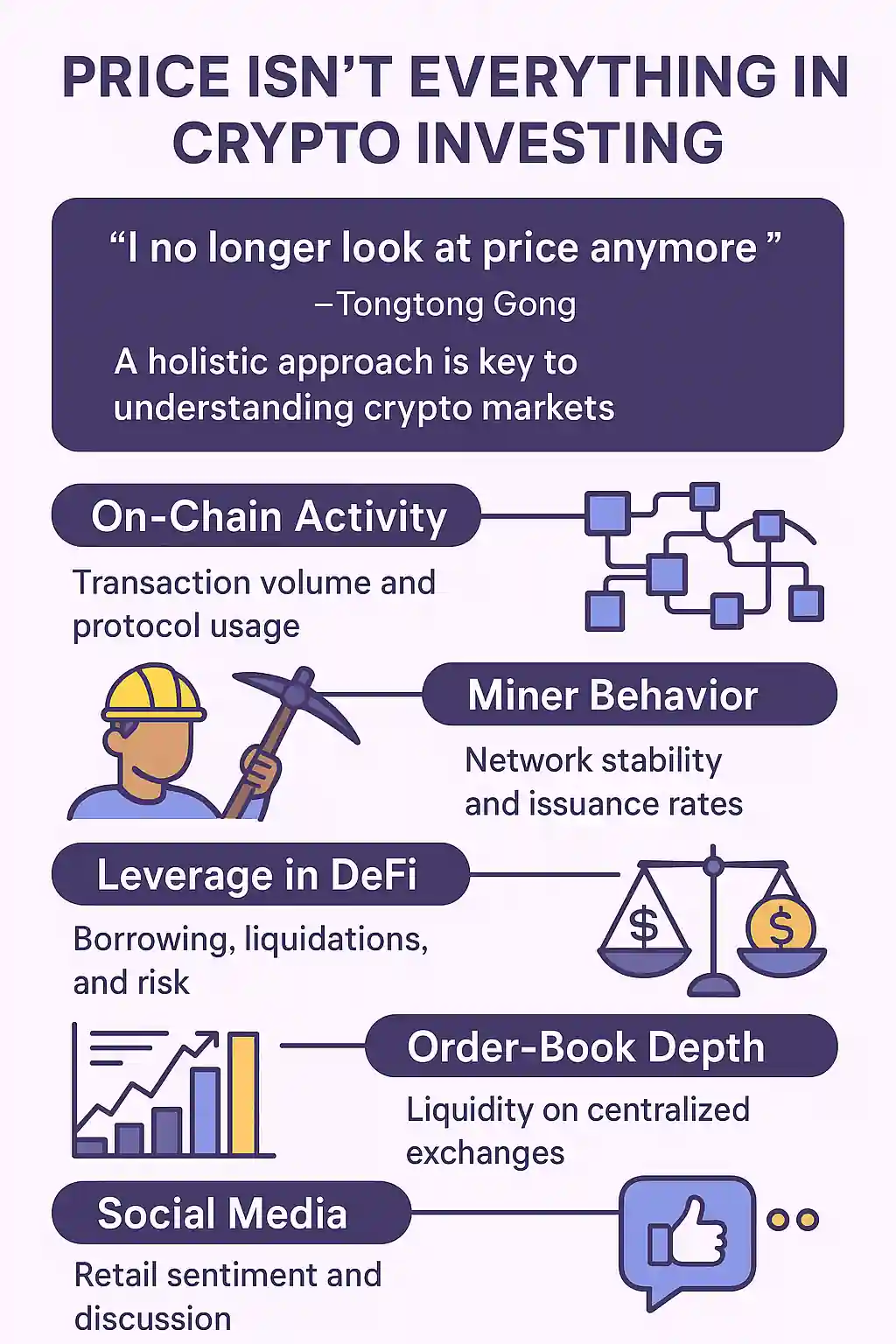

“I no longer look at price anymore.”

She argues that Bitcoin‘s role as “digital gold” is firmly established, and focusing purely on charts can cause investors to miss critical market signals. A holistic approach is now essential to navigate the complex crypto ecosystem.

A 360-Degree View of the Crypto Market

Gong promotes what she calls a full-spectrum perspective on crypto investing. This begins with on-chain activity—a direct indicator of real user engagement and demand. Metrics like transaction volume and protocol usage show the health of the network beyond price volatility.

Next, she tracks miner behavior, which impacts network stability and Bitcoin issuance rates. Miners’ decisions can reflect confidence or stress in the market.

She also emphasizes leverage in DeFi protocols, where borrowing activity reveals broader risk appetite. Tracking metrics like liquidation rates and borrowing interest rates helps assess market stress or exuberance.

Order-book depth on centralized exchanges is another vital layer. If large trades can drastically move the market, it signals shallow liquidity and potential volatility.

Finally, Gong keeps a close eye on stablecoin flows. Stress in USD-pegged stablecoins like USDT or USDC often signals incoming volatility, especially during market dislocations.

Social Media as a Market Barometer

Retail-focused crypto influencer Wendy O offers a different but equally valuable perspective. She watches social media mentions, especially on platforms like YouTube, Reddit, and X (formerly Twitter). According to her, retail chatter often front-runs altcoin breakouts.

Wendy says she reads all user comments and blends sentiment analysis with news trends, technical patterns, and community feedback to form her market views.

Her approach confirms that retail behavior is not just noise. It brings liquidity and demand for the very platforms and tokens builders are creating.

Institutional and Retail Insights Working Together

Combining institutional-level on-chain metrics with retail sentiment gives analysts a more accurate and actionable view of the crypto economy.

Gong explains,

“Digital assets are created on-chain. They have value because of the crypto economy behind them.”

Wendy O adds,

“Retail users don’t just speculate—they use the platforms, test the tech, and give real-time feedback.”

Their dual approach—data-driven macro analysis combined with community sentiment—delivers a full picture of what drives crypto markets day and night.

Understanding Crypto Requires More Than Charts

Today’s crypto landscape moves fast. To stay ahead, investors must look beyond candlesticks. Real value lies in protocol activity, market depth, liquidity dynamics, and community signals.

Crypto markets never sleep—and neither do the on-chain and off-chain metrics that truly shape their direction.