Coinbase Shares Fall Sharply After Record Peak

Coinbase stock (NASDAQ: COIN) has pulled back sharply since hitting a record of $444.64 on July 18. On August 1, Coinbase shares dropped 16.7% following a disappointing earnings report, creating a notable bear gap.

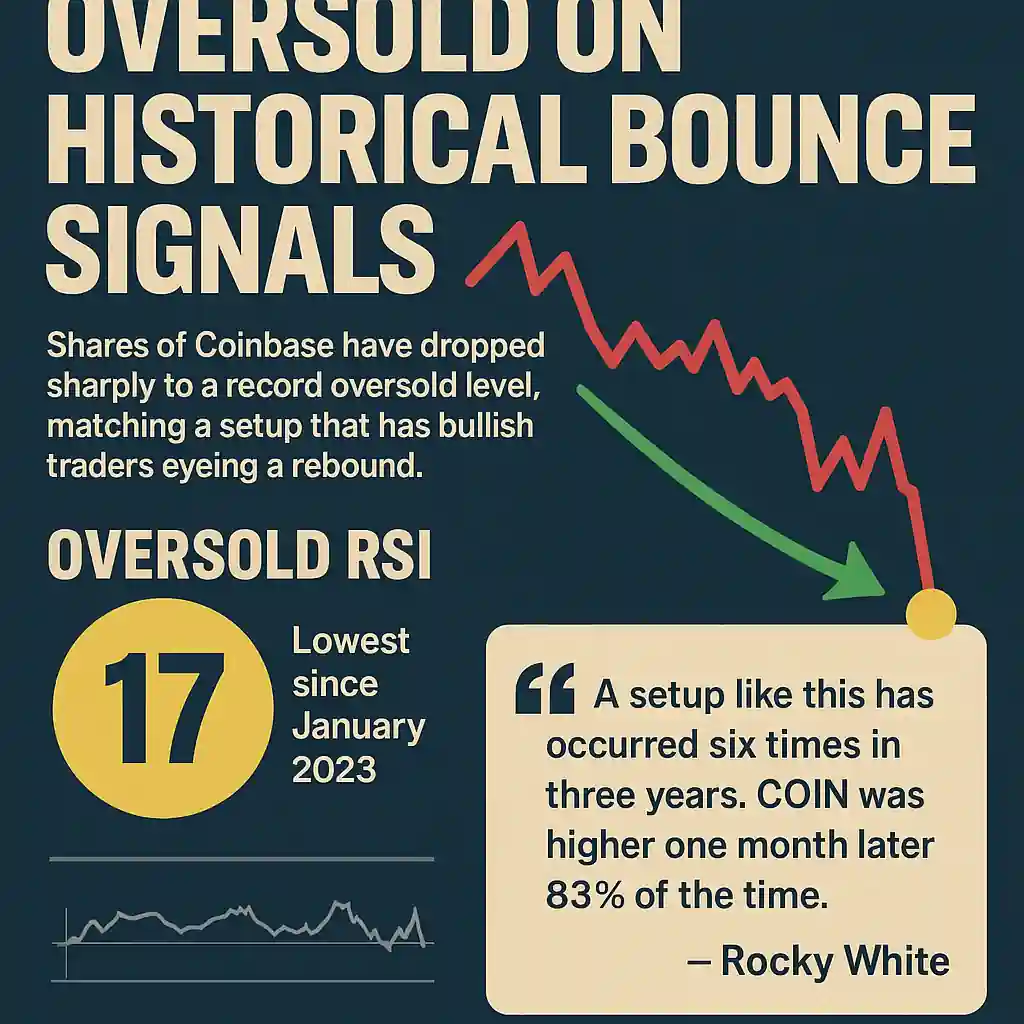

The drop reflects short-term pressure on the crypto trading platform. However, for bullish traders, Coinbase now flashes a compelling technical signal.

Oversold RSI Indicates Possible Rebound for Coinbase

Coinbase’s 14-day Relative Strength Index (RSI) has fallen to 17, deep in oversold territory. An RSI below 30 often suggests a possible bounce.

According to analysts, this setup may create a strong short-term buying opportunity. Historically, similar RSI levels have preceded significant gains in Coinbase stock.

Technical Setup Aligns With Historical Bounce Signals

Rocky White, Senior Quantitative Analyst at Schaeffer’s Investment Research, highlights a unique pattern forming.

Coinbase is now within 0.75 of its 80-day trendline’s 20-day average true range (ATR). It also spent 80% of the last 10 days and two months above that trendline.

This exact setup has happened six times in the past three years. In 83% of those cases, Coinbase stock rose one month later—by an average of 13.1%.

A 13.1% move from Coinbase’s current price of $301.23 would bring it to around $340.69.

Short Interest and Options Activity Could Add Fuel

Coinbase may also benefit from short covering. Currently, short interest equals 6.4% of its float—enough to drive a rally if sentiment turns.

Options data supports this potential. COIN’s 10-day put/call volume ratio stands at 0.64, placing it in the top 2% of bearish activity over the past year.

Although calls still dominate in volume, the surge in put buying suggests traders expect volatility. A shift in this sentiment could create upside pressure.

Institutional Support for Coinbase Remains Strong

Despite recent weakness, Coinbase remains a leader in crypto finance. As the only crypto exchange in the S&P 500, Coinbase continues to attract long-term institutional investors.

The GENIUS Act, recently passed by U.S. lawmakers, further boosts Coinbase’s long-term regulatory outlook. Analysts expect increased institutional participation in the crypto market.

What Traders Should Watch in the Coming Weeks

If historical signals hold, Coinbase may rally over the next 30 days. Technical traders should monitor the 80-day trendline and key resistance near $340.

Volume, RSI shifts, and options activity will likely provide further clues. Short squeezes and sentiment reversal could boost Coinbase higher.

However, traders should manage risk. A failure to hold the $300 support level might invalidate the setup and delay recovery.