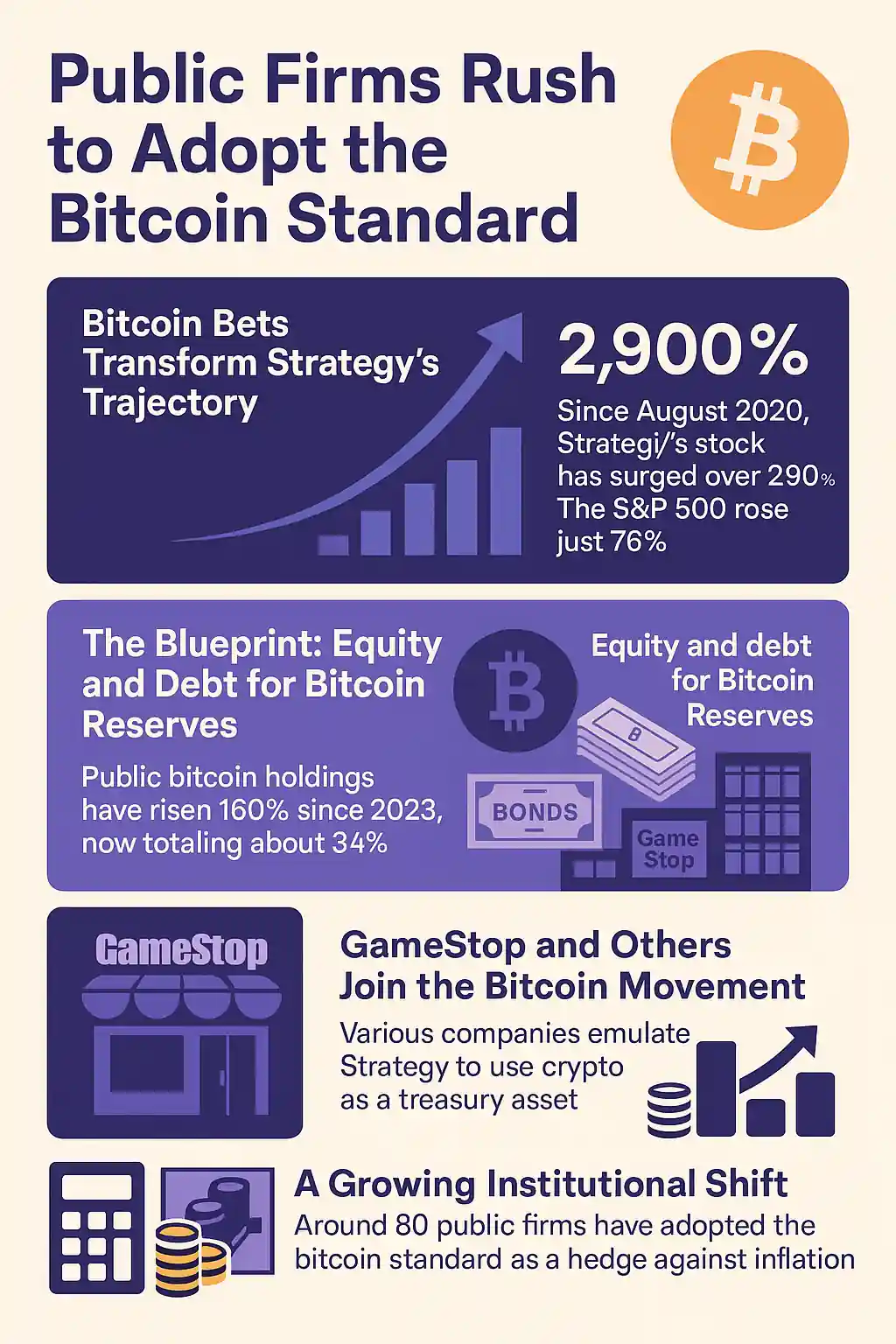

Public Firms Rush to Adopt the Bitcoin Standard

The bitcoin strategy pioneered by Strategy (formerly MicroStrategy) is now being copied by dozens of public firms. By converting corporate reserves into bitcoin, these companies hope to mirror the explosive gains Strategy enjoyed.

Spearheaded by Michael Saylor, Strategy’s bold move began in August 2020. The firm spent $40.7 billion acquiring over 580,000 bitcoin, turning it into the largest corporate holder of the asset.

Bitcoin Bets Transform Strategy’s Trajectory

Since adopting the bitcoin standard, Strategy has seen its stock soar by more than 2,900%. For context, the S&P 500 grew just 76% during the same period.

The firm’s meteoric rise has drawn attention. GameStop (GME), Trump’s family media company, and dozens of other publicly traded firms are now emulating this high-risk, high-reward approach.

The Blueprint: Equity and Debt for Bitcoin Reserves

The formula is simple: raise funds via equity or debt, then buy bitcoin. Strategy proved this tactic works when executed consistently at scale.

According to Bernstein analyst Gautam Chhugani, public companies have increased bitcoin exposure by 160% since 2023. These firms now control about 3.4% of all bitcoins in circulation.

This growth highlights a major shift. Bitcoin is no longer seen solely as a speculative asset. For these companies, it’s a strategic reserve and potential inflation hedge.

GameStop and Others Join the Bitcoin Movement

GameStop, once known only for its meme stock status, is now joining the bitcoin wave. Along with other firms from diverse industries, it’s adopting Saylor’s blueprint.

From software companies to media firms, the appeal is the same: leverage crypto as a treasury asset to drive long-term value and stock growth.

These organizations aren’t just dipping a toe into crypto. They’re committing capital, restructuring balance sheets, and publicly aligning themselves with the bitcoin economy.

A Growing Institutional Shift

Bernstein and Coinkite estimate that 80 public companies have embraced this model. That number is expected to grow as macroeconomic conditions push firms toward scarce, deflationary assets.

Critics argue that relying too heavily on volatile bitcoin may destabilize corporate finances. But supporters see it as a bold bet on digital scarcity and the future of finance.

Either way, the numbers speak volumes: $40.7 billion invested, 580,000 bitcoins held, and a near 3,000% gain in share price for the early adopters.

Bitcoin Becomes a Corporate Reserve Asset

The movement is clear. The bitcoin standard has gone corporate. As inflation concerns persist and digital assets mature, more companies are making room for bitcoin in their treasuries.

What started as an experiment is now a widespread financial strategy, reshaping how corporations manage cash and communicate their vision to investors.