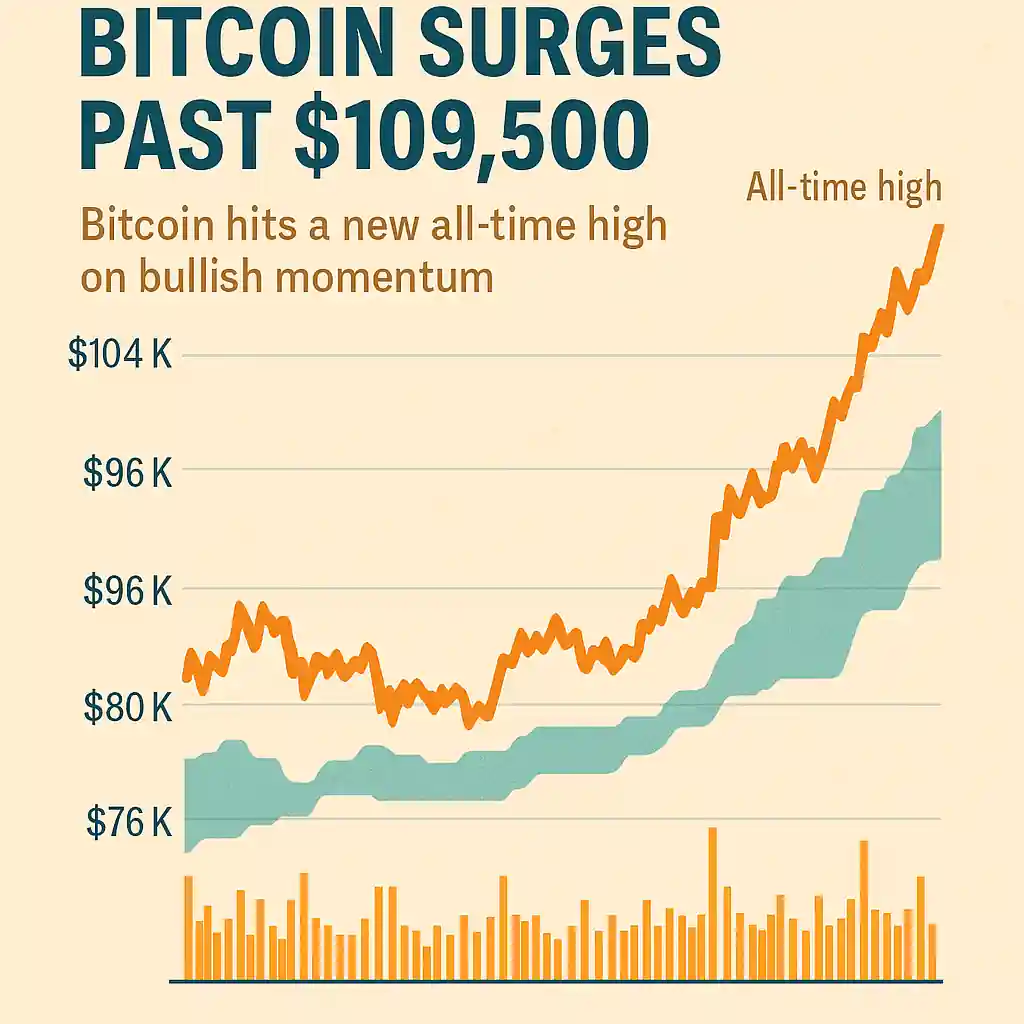

Bitcoin Surges Past $109,500 on Bullish Momentum

Bitcoin hit a new all-time high of $109,500 on Wednesday, driven by growing investor confidence and improving U.S. regulatory signals. The cryptocurrency has gained over 40% since bottoming near $76,000 in early April.

The rally reflects shifting sentiment across markets. Investors are increasingly in “buy-the-dip” mode, according to Sean Farrell of Fundstrat. “A few months ago, it was sell the rip. Now it’s the opposite,” he wrote in a client note.

Regulatory Tailwinds Boost Bitcoin Sentiment

A major driver behind Bitcoin’s momentum is progress in Washington. On Monday, the U.S. Senate advanced a stablecoin regulation bill, a move seen as a stepping stone to broader crypto legislation.

Sean Farrell called the bill a “barometer for broader legislative progress.” Its passage could accelerate laws supporting altcoins and possibly lead to a U.S. Bitcoin reserve strategy. A final vote could happen this week.

Trump Administration Embraces Crypto Policy Shift

Since President Trump returned to office, his administration has made several pro-Bitcoin appointments. One major change: Paul Atkins, a vocal crypto supporter, replaced Gary Gensler as SEC chair in January.

“An industry that was hunted for years now has regulators who are embracing it,” said Mike Novogratz, CEO of Galaxy Digital. The shift in tone is a sharp reversal from the enforcement-heavy stance of previous years.

Coinbase Joins S&P 500 in Major Industry Milestone

Coinbase (COIN) added to the industry’s momentum by joining the S&P 500 index this week — the first crypto exchange to do so. This move gives Bitcoin greater institutional visibility and validates the broader crypto market.

With crypto becoming part of traditional financial benchmarks, investors view Bitcoin as less speculative and more mainstream. Institutional participation continues to rise.

Corporate Bitcoin Adoption Hits New Highs

Companies are also loading up on Bitcoin. Following the lead of Strategy (formerly MicroStrategy), more than 80 global firms have adopted the “Bitcoin Standard” and now hold Bitcoin on their balance sheets.

According to Bernstein analyst Gautam Chhugani, corporate Bitcoin holdings have surged to 720,000 tokens — or 3.4% of total supply. That’s a 160% increase since late 2023. Strategy remains the largest corporate holder.

Analysts Set Bold Price Targets for Bitcoin in 2025

With macro tailwinds, rising adoption, and legislative clarity, analysts are turning increasingly bullish. Bernstein forecasts that Bitcoin could hit $200,000 by the end of 2025.

That would nearly double the current price, assuming no major regulatory or economic disruptions. For now, momentum remains firmly on Bitcoin’s side.