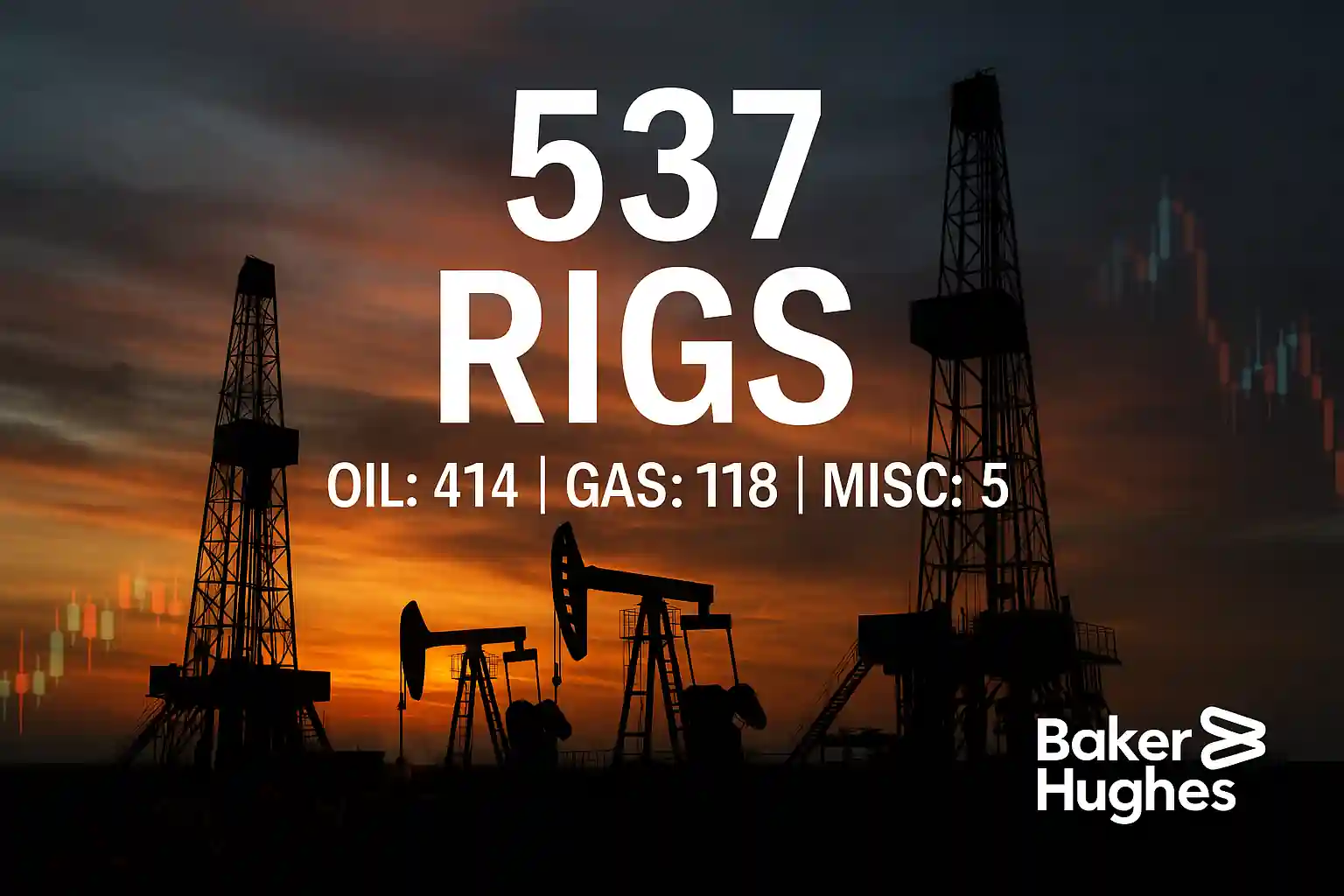

Rig Count Rises in Latest Baker Hughes Report

The total number of active drilling rigs for oil and gas in the United States rose this week, according to Baker Hughes. The increase brought the total rig count to 537. While higher than last week, the figure remains down 45 compared to the same time last year.

Oil and Gas Rig Breakdown

The total number of active drilling rigs for oil and gas in the United States rose slightly, but the breakdown shows mixed trends. Oil rigs increased by 2 to reach 414, though this is still 69 fewer than a year ago. Gas rigs fell by 1 to 118, representing a 24-rig gain year over year. Miscellaneous rigs held steady at 5.

US Crude Oil Production Slips

The total number of active drilling rigs for oil and gas in the United States rose modestly, but output tells another story. The latest EIA data showed weekly crude production slipped from 13.439 million bpd to 13.423 million bpd. This marks a 140,000 bpd decline since the start of the year.

Frac Spread Count Hits Four-Year Low

The total number of active drilling rigs for oil and gas in the United States rose, yet completions activity is lagging. Primary Vision’s frac spread count dropped by 3 to 162 during the week of August 29. This is the lowest level in more than four years, highlighting the difficult market environment.

Regional Trends in the Permian and Eagle Ford

The total number of active drilling rigs for oil and gas in the United States rose overall, but regional data shows weakness. In the Permian Basin, rigs fell by 1 compared to last week, now 52 below last year’s levels. The Eagle Ford stayed flat at 39, which is 9 fewer than the prior year.

Oil Prices Weigh on Drilling Activity

The total number of active drilling rigs for oil and gas in the United States rose, but low prices remain a challenge. At 10:14 p.m. ET, WTI crude traded down $1.51 (-2.38%) at $61.97. Brent was also lower, off $1.41 (-2.10%) at $65.58, nearly $2 below last week’s prices.

Implications for Energy Markets

The total number of active drilling rigs for oil and gas in the United States rose, though overall activity signals caution. Lower production, a shrinking frac spread count, and regional declines suggest limited growth ahead. Producers are balancing cost efficiency with market uncertainty.

Outlook for US Drillers

The total number of active drilling rigs for oil and gas in the United States rose this week, but structural challenges persist. Unless oil prices rebound significantly, operators may continue to scale back. Investors will be watching future Baker Hughes reports, EIA data, and OPEC+ decisions to gauge direction.