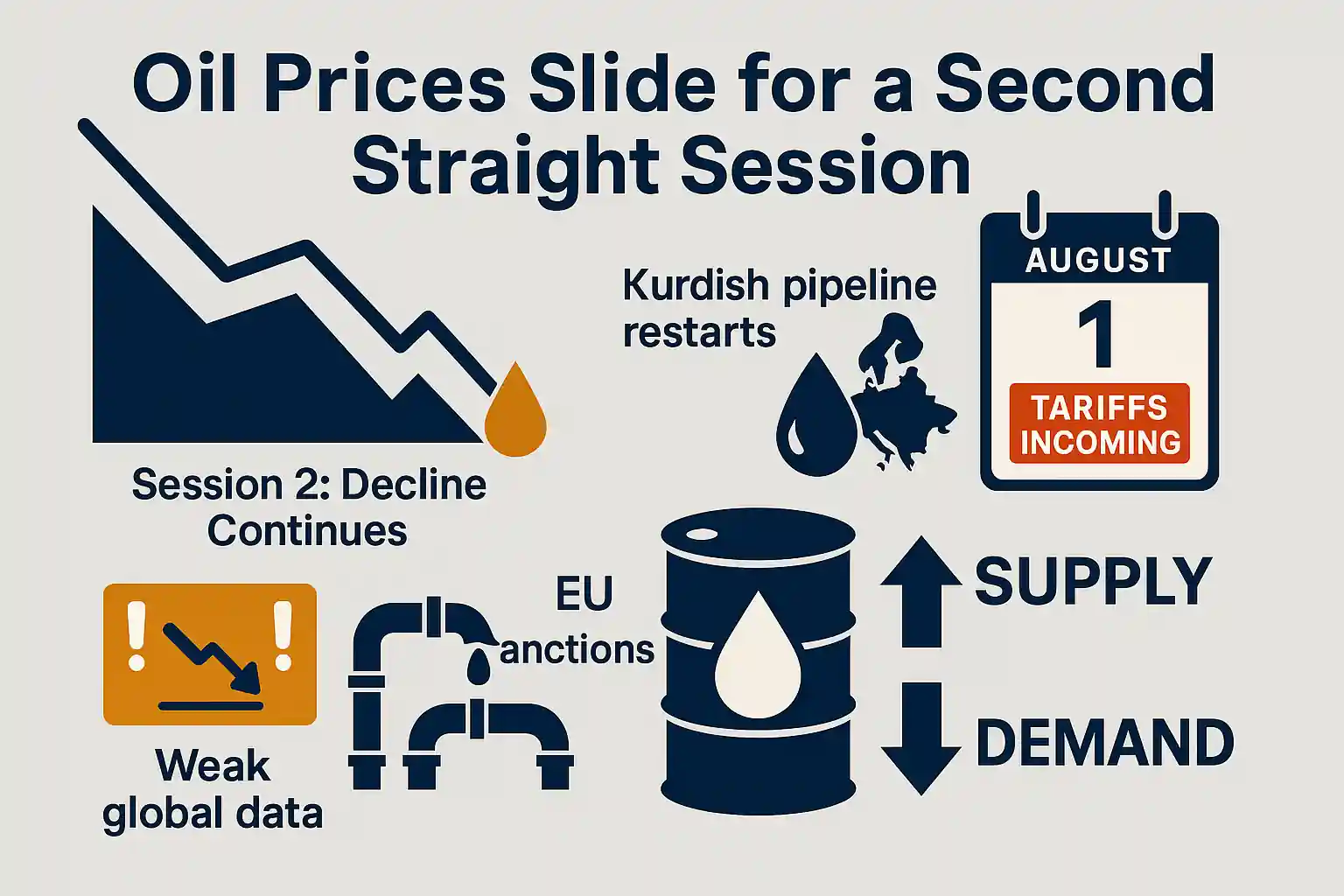

Oil Prices Slide for a Second Straight Session

Oil prices fell again today, extending losses for a second session. Crude and gasoline prices are both trending lower, with gasoline hitting a two-week low. Concerns around global economic growth and a potential oil surplus are pushing prices down.

Tariff Threats Raise Demand Concerns for Oil

President Trump announced that reciprocal tariffs will rise on August 1 for countries without trade deals with the U.S. This is fueling fears of slower global growth and reduced oil demand. Investors now expect weaker industrial activity, which often correlates with reduced energy consumption.

Weak Economic Data Deepens Oil Market Anxiety

Today’s global economic data reinforced the bearish sentiment in oil markets. The U.S. Richmond Fed manufacturing index dropped 12 points to -20 in July, hitting an 11-month low. Meanwhile, the ECB’s latest Bank Lending Survey revealed continued weak loan demand in the Eurozone during Q2.

Dollar Weakness Offers Limited Support for Oil

A weaker U.S. dollar helped slow the decline in oil prices, offering slight support. Typically, a soft dollar makes oil cheaper for international buyers. However, this effect wasn’t strong enough to offset broader bearish pressure stemming from demand fears.

Iraq Set to Resume Oil Exports via Turkey Pipeline

Crude prices are under additional pressure following Iraq’s approval to resume oil exports from its northern Kurdish region. The Iraq-Turkey pipeline had been inactive since March 2023. Kurdistan aims to supply 230,000 barrels per day, further boosting Iraq’s output—already the second-largest in OPEC.

EU Sanctions on Russian Oil Offer Mild Support

Oil prices had some residual support from last week’s EU sanctions on Russian petroleum. The latest package targets over 400 ships in Russia’s shadow fleet and blocks 20 more banks from SWIFT. It also blacklists a major Indian refinery linked to Russia’s Rosneft. While significant, these actions have had limited near-term impact on supply.

OPEC+ Production Increases Amplify Glut Fears

On July 5, OPEC+ agreed to raise crude oil output by 548,000 barrels per day starting August 1, exceeding expectations. This follows earlier hikes of 411,000 bpd in both June and July. OPEC+ is working to reverse its 2-year production cut, with plans to fully restore 2.2 million bpd by September 2026.

Saudi Arabia Targets Compliance with More Oil

Saudi Arabia signaled additional increases may follow, targeting overproducing OPEC+ members like Kazakhstan and Iraq. The strategy is designed to suppress prices and reassert discipline within the alliance. Meanwhile, total OPEC+ crude production rose by 360,000 bpd in June, reaching a 1.5-year high of 28.10 million bpd.

Oil Market Faces Bearish Headwinds

The combination of weak demand, rising supply, and political uncertainty continues to weigh on oil. With production rising and macroeconomic indicators flashing red, oil could face further declines in the coming weeks unless geopolitical risks or unexpected outages emerge to rebalance the market.