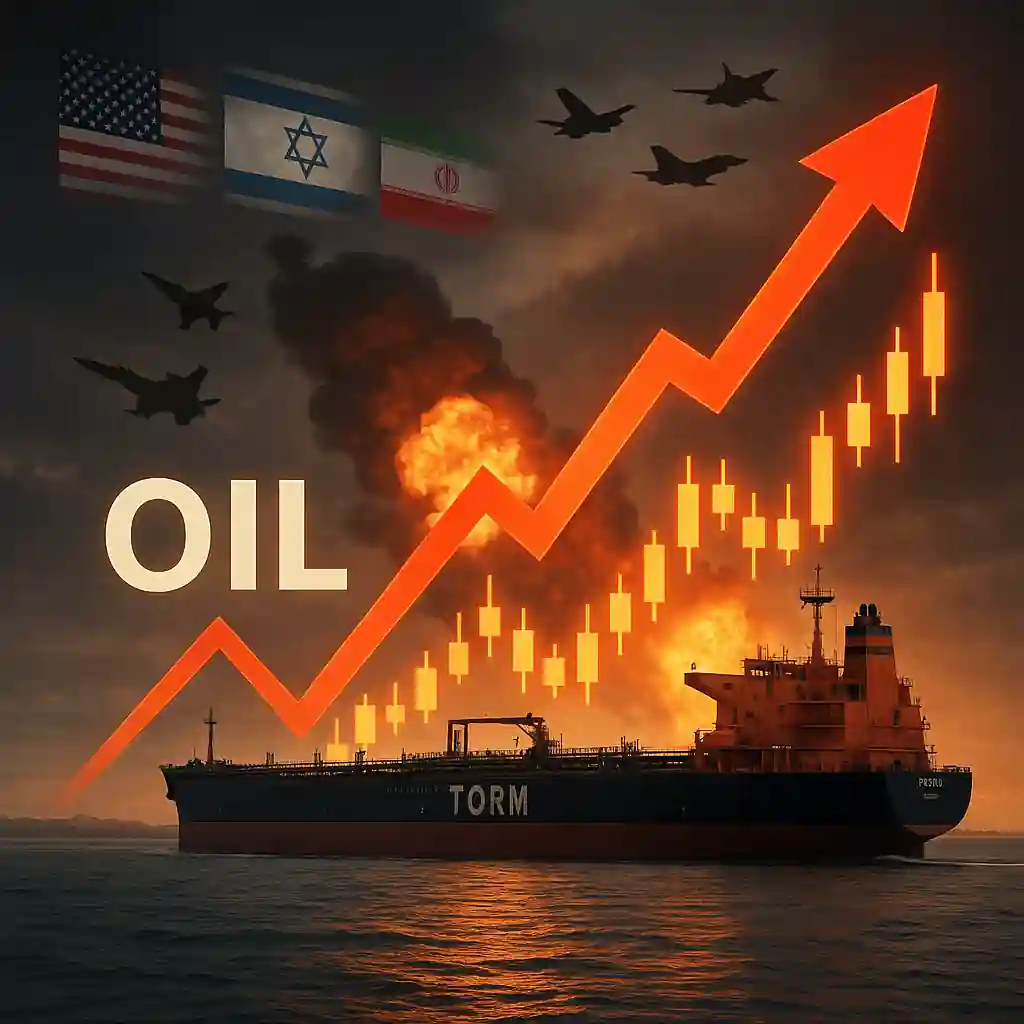

Oil Prices Surge 10% Amid Middle East Tensions

Oil has climbed roughly 10% since the outbreak of the Israel-Iran conflict. Traders now fear further gains if Iran destabilizes. As a major oil producer, Iran holds significant influence over global oil flows. Any escalation could disrupt oil supplies and push prices even higher.

Markets React to U.S. Involvement Speculation

On Thursday, oil fluctuated as Wall Street watched for U.S. military action. President Trump’s public statements suggest a possible intervention alongside Israel. Social media hints about targeting Iran’s nuclear infrastructure have only intensified volatility in the oil market.

Price Movements Reflect War Uncertainty

West Texas Intermediate (WTI) futures settled at $75.49 per barrel, while Brent crude stood at $76.22. The day before, prices had ticked higher on larger-than-expected U.S. inventory draws. However, the broader pattern has been a choppy, seesaw movement as traders weigh conflict-related risks.

Analyst Insights Point to Sustained Oil Price Risks

Daniel Dicker, founder of The Energy Word, noted that the U.S. remains the “wild card” in this conflict. JPMorgan analysts also warned that while geopolitical oil shocks are often short-lived, regime changes can cause lasting disruptions to oil markets.

Historical Regime Changes Offer Price Clues

JPMorgan data shows that since 1979, eight regime changes in oil-producing nations have triggered sharp oil price spikes. On average, oil surged 30% from the initial shock, with some events leading to a 76% peak rise. Such shifts can permanently affect oil supply chains.

Iran’s Role in OPEC and Potential Threats

Iran is the fourth-largest oil producer in the OPEC+ alliance. So far, fighting hasn’t disrupted its oil output. OPEC had even raised quotas ahead of Israel’s strike. If Iran remains stable, oil prices might stabilize too. But that remains far from guaranteed in today’s climate.

Strait of Hormuz Closure Would Trigger Oil Surge

A worst-case scenario would be Iran closing the Strait of Hormuz. This chokepoint handles a fifth of global oil trade. JPMorgan analysts warn that such a move could send oil past $100 per barrel. Yet they view this outcome as unlikely, given the high risk of open warfare.

Tanker Rates Soar as Conflict Intensifies

Shipping data reflects the market’s nervousness. Tanker rates in the Middle East have jumped 50% since the fighting began. According to TORM, one of the largest product tanker firms, this surge indicates traders are paying a premium to move oil in risky waters.