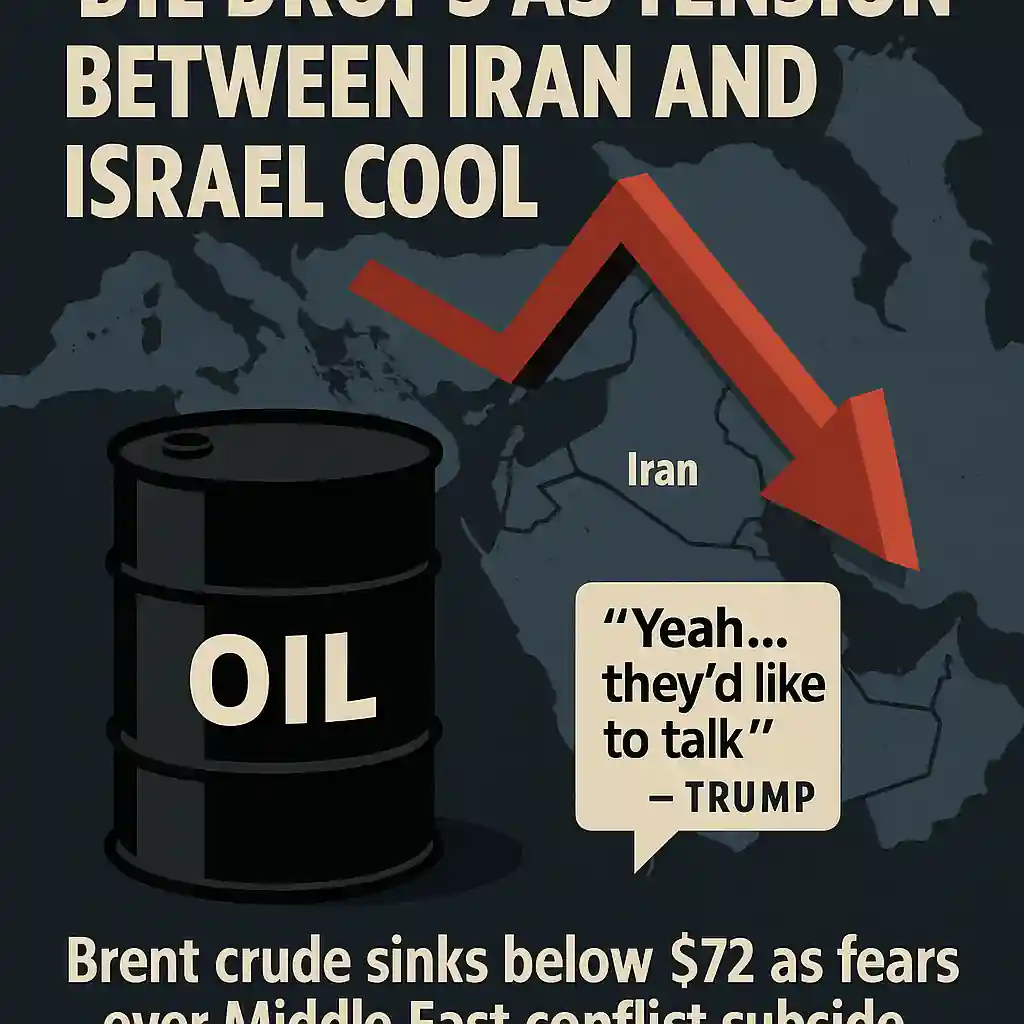

Oil drops as tensions between Iran and Israel cool

Oil prices fell on Monday, reversing earlier gains sparked by Middle East conflict fears.

Brent crude dropped below $72 per barrel, while WTI crude slipped to under $71. Both contracts declined nearly 4%.

The retreat came after signs that Iran may seek to de-escalate tensions with Israel, calming fears of broader war.

Oil markets initially surged when hostilities flared. Now, traders are pricing in a lower risk of supply disruptions.

Tehran may reopen nuclear talks, easing oil risk premium

Markets were buoyed by a Wall Street Journal report suggesting Tehran is open to reviving nuclear negotiations.

President Trump confirmed the possibility, saying, “Yeah… they’d like to talk,” adding that talks should’ve come earlier.

A diplomatic breakthrough would reduce the geopolitical risk premium built into oil prices over recent weeks.

For now, investors are cautiously optimistic that conflict won’t escalate further across the region.

Oil’s volatility driven by geopolitics and tariffs

Oil has traded erratically in 2025, influenced by war risk and U.S. tariff uncertainty.

Trump’s trade agenda has strained global economic outlooks, weakening demand projections for oil and fuel.

Still, Monday’s 4% oil pullback reflects reduced concern over immediate conflict. Traders are reassessing short-term risks.

If diplomacy prevails, oil may stabilize. But if talks stall or tensions return, prices could spike again.

Markets rebound as risk appetite returns

U.S. equities surged Monday following last week’s sell-off. The Dow, S&P 500, and Nasdaq each gained over 1%.

The move signals investors are shifting back into risk assets now that war fears are fading.

Trump said there’s a “good chance” of peace between Israel and Iran, though tensions “may need to play out.”

Markets responded positively, with oil falling and stocks climbing in tandem — a typical risk-on signal.

Oil’s future linked to diplomatic efforts and Fed policy

Beyond geopolitical headlines, oil prices will also react to Federal Reserve decisions and global demand recovery.

The Fed is expected to hold rates steady Wednesday, despite political pressure to cut.

Lower rates would typically boost oil by weakening the dollar and supporting growth, but the Fed may stay cautious.

Meanwhile, the EU reportedly agreed to a 10% tariff baseline to avoid harsher U.S. import penalties.

This trade clarity, if confirmed, could improve business sentiment and global oil demand expectations.

Outlook: Oil may stabilize if peace talks progress

Oil markets remain vulnerable to geopolitical shock, but the latest news suggests easing pressure.

If Iran and Israel avoid escalation and resume dialogue, oil prices could fall further.

That would benefit global consumers but challenge producers who rely on higher prices to balance budgets.

The balance of risks still favors volatility. Investors will watch OPEC+ closely, along with U.S. foreign policy.