Oil Prices Jump on US-China Trade Agreement Framework

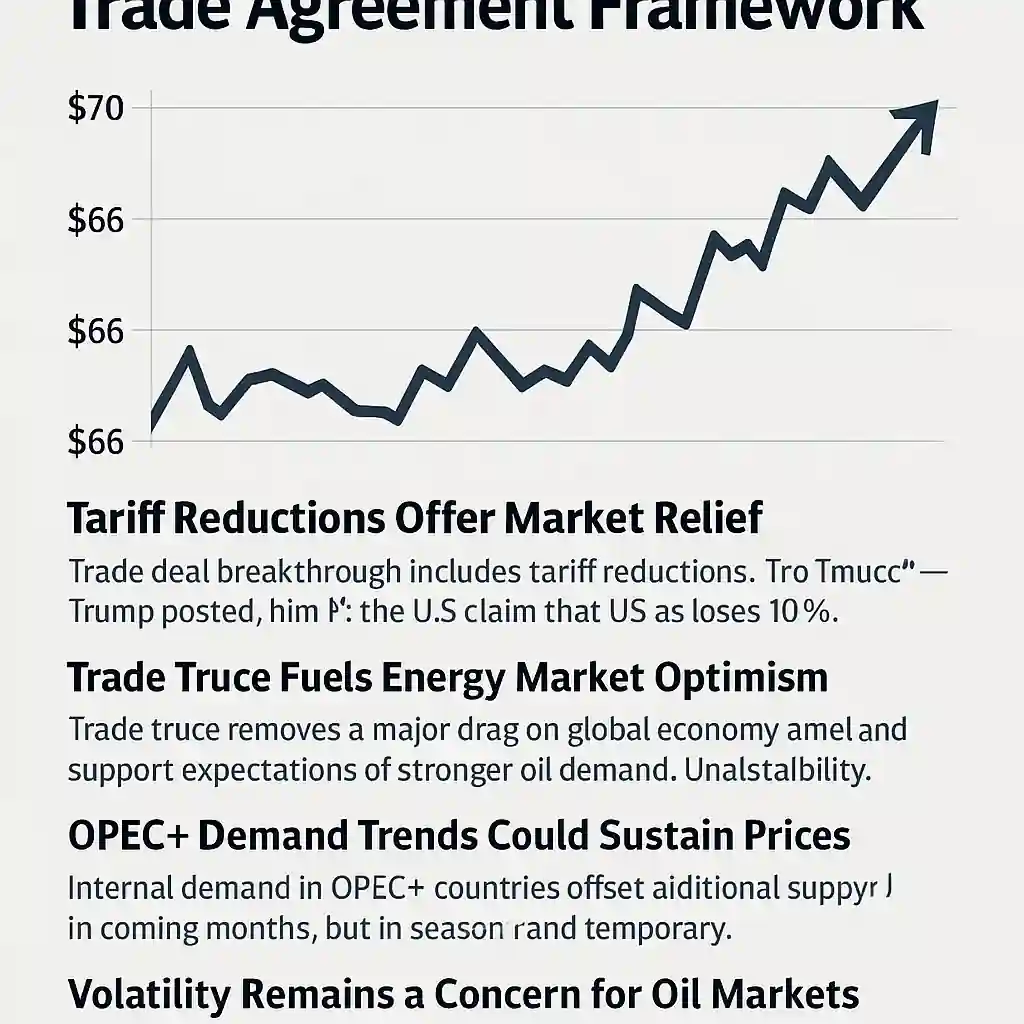

Oil prices surged Wednesday after the United States and China announced progress toward a comprehensive trade deal. Brent crude rose 1.7% to $68.01 a barrel, while West Texas Intermediate climbed 2.1% to $66.39.

This price jump came shortly after President Donald Trump posted that a new agreement was “DONE, SUBJECT TO FINAL APPROVAL WITH PRESIDENT XI AND ME.” Traders welcomed this development, seeing it as a potential breakthrough in restoring stability between the world’s two largest economies.

Tariff Reductions Offer Market Relief

The breakthrough also included key tariff changes. “WE ARE GETTING A TOTAL OF 55% TARIFFS, CHINA IS GETTING 10%,” Trump posted, hinting at a new balance that may de-escalate tensions.

This eased fears that trade disputes could harm global demand for oil, which had been a growing concern among investors and analysts over the past months.

Trade Truce Fuels Energy Market Optimism

The trade truce alleviates a major drag on the global economy and supports expectations for stronger oil demand. If tariffs continue to decline and industrial activity rebounds, oil consumption could rise significantly.

Both nations are major players in the oil market. The US is the world’s largest oil producer, and China is a leading importer. Stability in their economic relationship is crucial for sustaining global energy flows and pricing.

OPEC+ Demand Trends Could Sustain Prices

Beyond trade headlines, internal demand in OPEC+ countries is also playing a role. Hamad Hussain, a commodities economist at Capital Economics, noted: “Greater oil demand within OPEC+ economies – most notably Saudi Arabia – could offset additional supply from the group over the coming months.”

Still, he cautioned that these demand increases are largely seasonal and temporary. Hussain predicts Brent crude will fall to $60 per barrel by year-end, despite current strength in the market.

Volatility Remains a Concern for Oil Markets

Even with this deal progress, the oil market remains highly reactive to political news. A final agreement between the US and China still requires formal approval from both leaders. If talks falter again, oil prices could quickly reverse course.

Investors are likely to remain cautious, watching for signs of policy shifts, supply updates, and global economic data before making long-term bets on oil.

Trade Hopes Breathe Life into Oil Market

The US-China trade breakthrough has temporarily boosted investor confidence, pushing oil prices higher and easing short-term demand concerns. But with seasonal trends and geopolitical risks still in play, the market’s next move will depend on what happens after Trump and Xi finalize the deal.

For now, oil remains in a bullish zone, but analysts expect some resistance as the year progresses.