MicroStrategy Outperforms Tech Sector in 2025

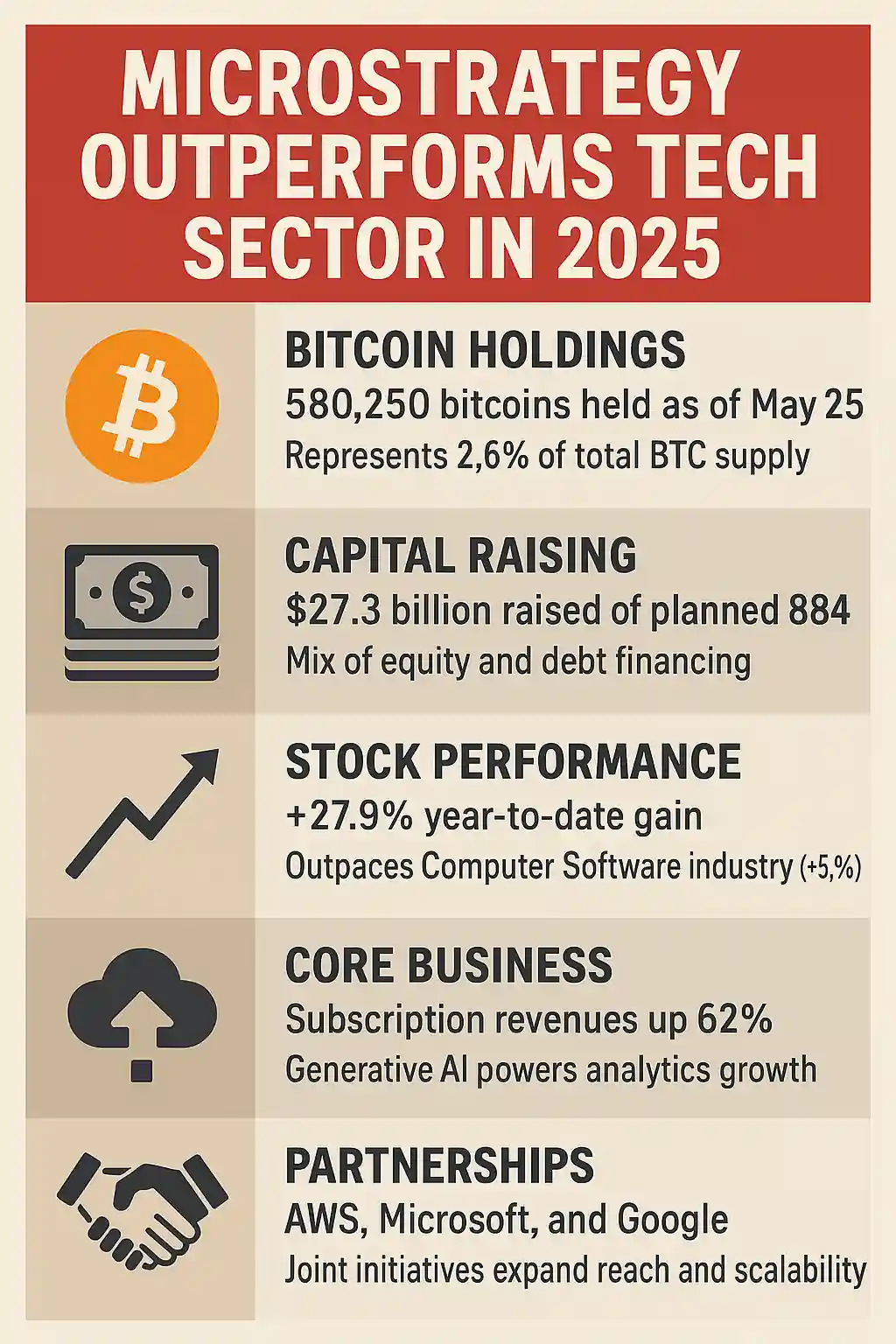

MicroStrategy is once again making headlines as it outpaces the broader tech market in 2025. The company’s shares have appreciated 27.9% year to date, significantly outperforming the Zacks Computer Software industry’s 5.9% rise and defying the broader Zacks Computer and Technology sector’s 1.7% decline.

At the heart of this rally is MicroStrategy’s aggressive Bitcoin strategy. As of April 27, 2025, the company held 553,555 bitcoins, representing 2.6% of all existing BTC. By May 25, that number had grown to 580,250 bitcoins, purchased at an average price of $69,979, for a total investment of $40.61 billion.

Bitcoin Holdings Drive Share Price and Yield

The bullish trend in Bitcoin, which now trades above $105,891, has been a boon for MicroStrategy. The company has already booked $5.8 billion in dollar gains as of April 28, with a year-to-date yield of 13.7%, keeping it on track to reach or exceed its revised 25% target for the year. Initial goals were more modest—only $10 billion in gains—but current momentum suggests $15 billion is within reach.

Disciplined Capital Raising Strategy

MicroStrategy continues to raise capital efficiently through a blend of equity and fixed-income offerings, supporting its 21/21 Bitcoin accumulation plan. Since October 2024, the firm has raised:

- $20.9 billion in equity

- $6.4 billion in fixed income

- Notably, $6.6 billion was raised via equity in 2025 alone, with an additional $3.4 billion from preferred and convertible securities, including the high-yield Strike (8% convertible) and Strife (10% fixed coupon perpetual).

The company still plans to raise a total of $84 billion—$42 billion each in equity and debt—by the end of 2027. As of now, $21.1 billion in equity and $35.6 billion in fixed income remain available under the plan.

MicroStrategy Outshines Other Bitcoin-Heavy Stocks

Compared to other public Bitcoin holders, MicroStrategy leads the pack. Shares of Marathon Digital, Semler Scientific, and KULR Technology have fallen 12.9%, 25.8%, and 67.9% YTD, respectively. In contrast, MicroStrategy has remained bullish, helped by strategic positioning and the increasing institutional acceptance of Bitcoin.

Cloud and Subscription Growth Bolster Core Business

While Bitcoin dominates headlines, MicroStrategy’s core business is also thriving. In Q1 2025, software subscription revenues grew 62% year-over-year, reaching $37.1 million, and accounting for 33% of total revenues. Subscription billings also jumped 38%, indicating strong future growth potential.

The company’s Strategy One platform continues to see strong demand across industries like banking, healthcare, insurance, and public services. MicroStrategy is also leveraging generative AI to power enterprise analytics, further expanding its capabilities.

Strategic Partnerships Strengthen MicroStrategy’s Reach

Strategic partnerships with Amazon Web Services, Microsoft, Google, and STACKIT provide additional tailwinds. These collaborations enhance MicroStrategy’s platform reach, ensure scalability, and support ongoing AI and blockchain integration.

Stable Outlook Despite Volatility

Despite Bitcoin’s inherent volatility, MicroStrategy appears stable. The company’s disciplined approach, capital structure, and software diversification provide a cushion against crypto market swings.

For Q2 2025, analysts maintain a steady EPS estimate of -$0.12, a notable improvement from -$0.76 in the year-ago period, signaling improving profitability and operational efficiency.