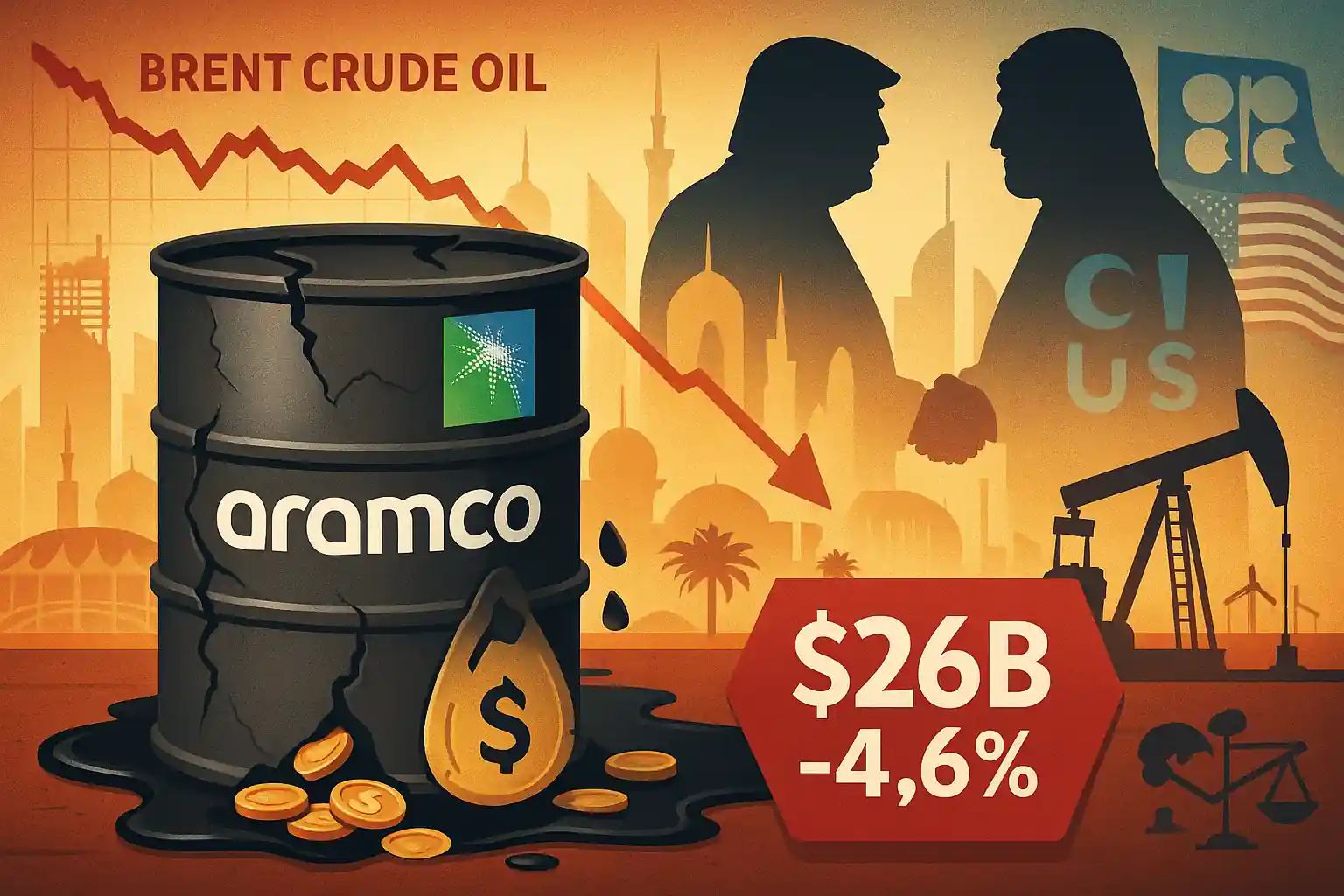

Oil prices drag down Aramco profits in Q1 2025

Saudi Arabia’s oil giant Aramco posted $26 billion in first-quarter profits, a 4.6% drop from the same period last year. Revenues reached $108.1 billion, slightly higher than Q1 2024 but still reflecting weaker oil market dynamics.

The dip in earnings comes as global oil prices remain under pressure due to economic uncertainty and shifting trade dynamics.

Oil-linked earnings hit as Aramco fuels Saudi goals

Despite still-strong results, falling oil prices are threatening Crown Prince Mohammed bin Salman’s bold development plans. The kingdom’s $500 billion Neom project, World Cup 2034 preparations, and massive infrastructure spending all depend on steady oil revenue.

Aramco’s performance is crucial, as it funds much of the Saudi government’s ambitions. But with Brent crude recently trading near $63 per barrel—down from $80 last year—Aramco may need to rely more on borrowing or reserves.

OPEC+ increases oil output amid market volatility

In a move that could further pressure prices, the OPEC+ alliance, led by Saudi Arabia, announced a production increase of 411,000 barrels per day next month. The boost comes as global uncertainty, partly linked to U.S. tariffs, rattles oil markets.

Analysts worry that oversupply could deepen price drops. For Saudi Arabia, balancing oil market share and revenue is becoming increasingly complex.

Trump ties remain strong as oil diplomacy continues

President Donald Trump is set to visit Riyadh on his first foreign trip since retaking office. Saudi Arabia has pledged to invest $600 billion in the U.S. during his term—Trump wants that number raised to $1 trillion.

This oil diplomacy underscores Saudi Arabia’s dependence on U.S. political ties and foreign partnerships to sustain its economic vision.

Aramco’s oil valuation faces global headwinds

Aramco stock traded just above $6 on Sunday, down from last year’s peak of $8. The company’s market value sits at $1.6 trillion, making it the sixth most valuable firm globally—behind tech giants like Microsoft and Apple.

Yet the company’s trajectory remains tied to oil prices, which are now vulnerable to economic slowdowns, trade tensions, and geopolitical shifts.

Oil-driven revenues power the Saudi state

Though only a fraction of Aramco is publicly traded, the bulk remains state-owned. That means most of its oil revenue directly funds Saudi Arabia’s budget and contributes to royal family wealth.

Aramco’s size and reach make it a key trendsetter in global oil markets. Its performance is often viewed as a barometer for the broader energy sector.

Oil outlook remains uncertain for 2025

CEO Amin H. Nasser acknowledged that “global trade dynamics affected energy markets in Q1.” With the oil landscape shaped by economic uncertainty, Aramco—and Saudi Arabia—face mounting pressure to sustain growth.

While oil demand may recover if trade tensions ease, current volatility makes long-term forecasts risky. For now, Aramco remains profitable but cautious.