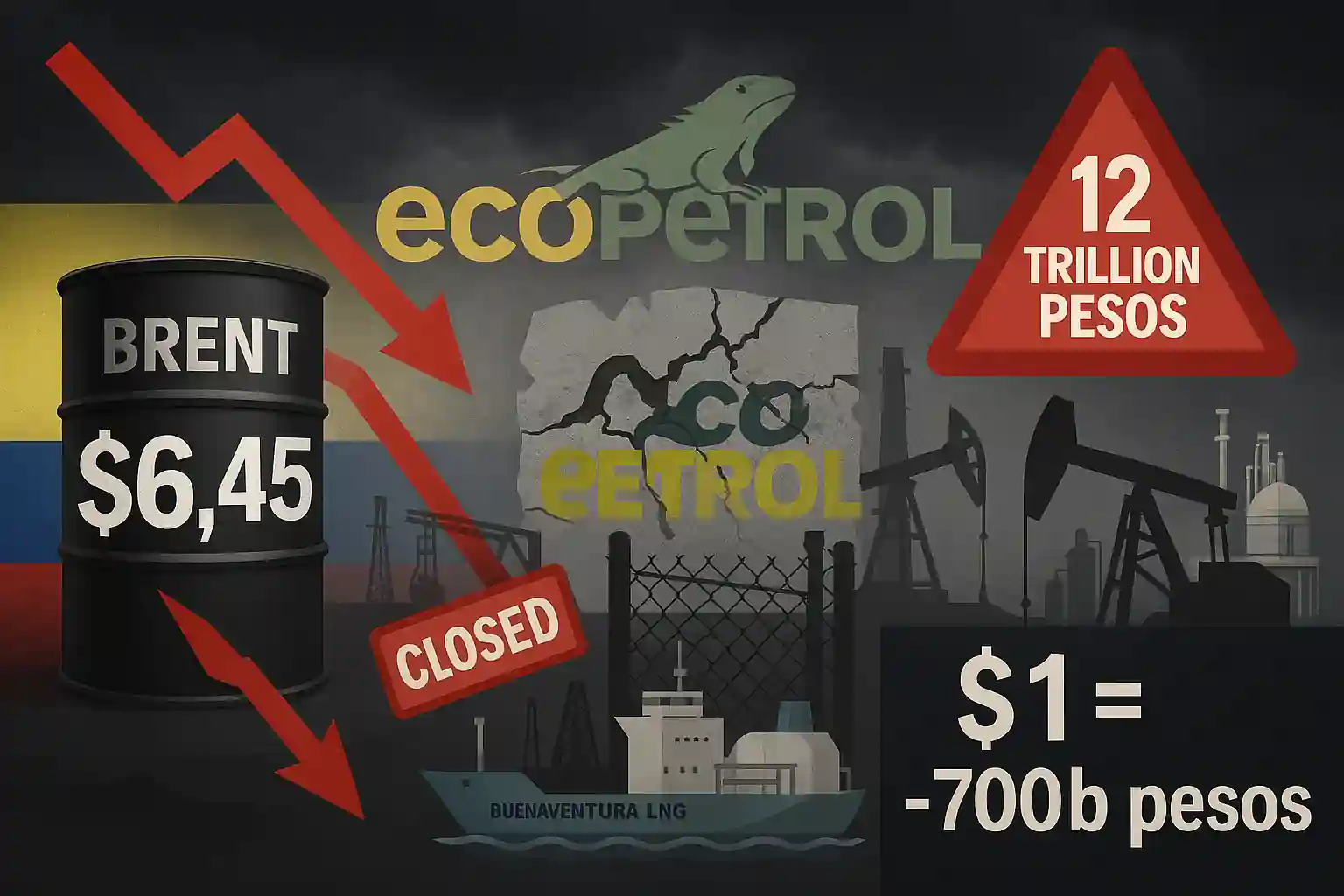

Oil Price Crash Could Slash Ecopetrol’s 2025 Profits

Ecopetrol, Colombia’s state-run oil firm, may see its profits plunge by up to 12 trillion pesos ($2.76 billion) this year, as falling oil prices force the company to reassess its operations. Company president Ricardo Roa issued the warning Friday amid Brent crude trading at $63.45 a barrel, down significantly from previous forecasts.

Tensions between the United States and China, amplified by new trade tariffs, have stoked fears of a global economic slowdown, weighing heavily on crude oil demand and prices.

Up to 30 Oil Fields May Be Shut

Ecopetrol currently manages 158 oil fields. However, between 20 to 30 fields may face closure due to unprofitability at current price levels. Roa said these fields are not major producers, but confirmed that their break-even costs are dangerously close to current Brent prices.

“We’ll have to eliminate them and focus on those with lower costs,” Roa said. He added that the company is already monitoring field profitability and could shut more sites if oil remains low.

Each Dollar Drop Hits Profits Hard

According to Ecopetrol, every $1 decline in international oil prices reduces:

- EBITDA by 900 billion pesos, and

- Net profit by 700 billion pesos.

“If we were considering prices at $73 and now they’re at $63, then we’re talking about a 12 trillion peso gap,” Roa explained.

These losses are especially concerning as Colombia’s economy grapples with rising fiscal pressure, shrinking tax revenues, and a growing need to increase debt and cut spending.

Natural Gas Expansion to Offset Losses

In a bid to diversify revenues and stabilize cash flow, Ecopetrol also announced plans to launch two new natural gas sale processes in 2025:

- June: Additional sales from domestic production

- July: Sales from imported gas via the Buenaventura port

Later this year, gas from an offshore block jointly operated with Brazil’s Petrobras is expected to enter the market, potentially covering up to 14% of Colombia’s domestic gas demand.